Are You Ready For Your Free Quote?

We Have Agents Ready To Take Your Call. Call Us NowWant To Review Your Options

WELCOME TO VIVNA INSURANCE

Where Life & Healthcare Cross Paths

Vivna Insurance helps individuals, families, and small businesses secure affordable health, life, supplemental, and dental and vision coverage. In addition, our licensed agents take time to review your needs, compare available options, and clearly explain coverage choices so you can make informed decisions with confidence.

Why Choose Vivna Insurance

Vivna Insurance provides personalized guidance across health, life, dental, vision, and supplemental coverage, helping individuals and families choose plans that truly fit their needs. 🤝

Because Vivna is licensed nationwide and appointed with major carriers, clients gain access to multiple options with expert support every step of the way. 🌎📋

Personalized Support

Our team takes the time to understand your doctors, budget, and coverage goals so we can recommend the plans that work best for you.

Nationwide Coverage

Whether you’re looking for local options or nationwide plans, Vivna helps you explore a wide range of insurance choices in your state.

Choose Your Carrier

We work with trusted carriers including UnitedHealthcare, Pivot Health, Oscar, Aflac, and others to provide competitive plan options.

Clear, Simple Guidance

We walk you through every step—from comparing plans to selecting coverage—so you always feel confident in your choice.

Testimonials From Our Clients

Our clients trust Vivna Insurance because we focus on clear guidance, honest advice, and helping people choose coverage that truly fits their needs. ⭐

From first-time buyers to families reviewing their coverage, our commitment to responsive service and reliable support continues long after enrollment. 👍

Treena M.

– Treena M.

Shanyn W-K.

Shanyn Warren-Kimsey

Lisa P.

Renewal period, and put off dealing with making this call because I dreaded it! But …I was blessed to get Heather to help me, and she was AMAZING! Called when she said she would and took 100% care of every step, including calling my doctors to ensure they were in the plans we were shopping. Thank you, Heather, for making an awful chore tolerable and, dare I say, enjoyable.

– Lisa P.

Jane U.

Alicia S.

Heather S. is FANTASTIC, and her customer service was remarkable! She walked me through the entire process and made me feel like family. Throughout my experience, she showed kindness and professionalism, responsiveness and genuine care – ensuring I was taken care of each step of the way. Great service and people! A+

– Alicia S.

Ieva W.

Jessica was a helpful agent, and I am so excited to have my insurance get going with her positive attitude!

Kimberly S.

Heather Sprague is bar none the best health insurance rep I’ve ever had. She personally calls you even on off-hours if you have a question, and she fixes any issues you might have. I can’t say enough good things about her and vivna – honest, trustworthy, reliable, and just good people who care!

– Kimberly S.

Nick G.

Affordable Health Insurance Nationwide

Click your state for a personalized quote from a licensed agent

Alabama

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

Nevada

New Hamp.

New Jersey

New Mexico

New York

North Carolina

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

Frequently Asked Questions From Our Clients

What is an ACA Marketplace Plan?

ACA plans are sold on the health care Marketplace (also known as Obama Care). Depending on your income, you may be eligible for government subsidies to help lower the cost of an ACA plan.

What types of insurance does Vivna offer?

Vivna offers Health Insurance, Dental & Vision coverage, Life Insurance, and Supplemental Insurance. Our advisors compare multiple plan options and guide you toward coverage that fits your needs and budget.

How do Vivna agents help me choose the right plan?

Our licensed agents review your doctors, prescriptions, goals, and budget. Then we compare multiple carriers and explain each option clearly, so you can choose the right plan with confidence.

Is there a cost to work with a Vivna Insurance agent?

No. Our services are completely free. You pay the same price whether you enroll on your own or receive expert help from a licensed Vivna agent.

Can Vivna help me understand my ACA Marketplace options?

Absolutely. We review subsidy eligibility, compare ACA Marketplace plans, explain out-of-pocket costs, and guide you through each step of the enrollment process from start to finish.

What is a short term medical plan?

Short-term plans can help you get the benefits you need in times when you may have a coverage gap — like when you’re in between jobs or waiting for other coverage to start.

Am I required to have Health Insurance?

No, you are not. There are specific States that have their own individual mandates, with possible TAX PENALTIES if you don’t have coverage. California, Massachusetts, New Jersey, Rhode Island, Vermont, and Washington, DC. It is always best to have Health Insurance.

Does Vivna work with multiple insurance companies?

Yes. Vivna partners with trusted carriers such as UnitedHealthcare, Pivot Health, Oscar, Aflac, OneShare Health, and UBA. Working with multiple companies allows us to offer more plan choices.

What are the durations of a Short Term medical plan.

UnitedHealthcare offers Short-Term medical plans ranging from 3 to 12 months.

Are there any plans that I don't have to renew every year?

Yes, many carriers, such as United Healthcare and Pivot Health, offer a Tri-Term plan. A TriTerm plan has a duration of 36 months.

Contact Vivna Insurance

888-730-6001

To complete the form below to request your personalized insurance review.

Get a Free Quote

For additional information about dental and vision care, you can explore trusted health resources such as the

National Institutes of Health (NIH) and the Centers for Disease Control and Prevention (CDC).

Vivna Insurance helps individuals and families compare coverage options, including Supplemental Insurance,

to support a well-rounded insurance strategy. To explore all coverage options and resources, visit the Vivna Insurance home page

or browse the latest guides in the Vivna Insurance Blog.

Health & Insurance Blog

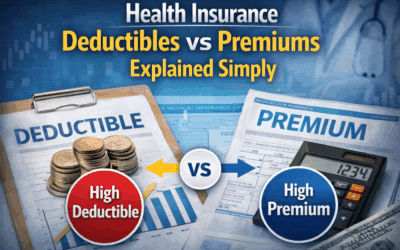

How Health Insurance Deductibles Work

Health Insurance Deductibles Work alongside premiums, copays, coinsurance, and out-of-pocket maximums. Learn how to compare plans with confidence.

What Health Insurance Covers Understanding Benefits & Coverage

What Health Insurance Covers includes preventive care, doctor visits, hospital services, and prescriptions. Learn what’s included and where gaps may exist.

Choosing Health Insurance Coverage | A Simple Plan Comparison Guide

Choosing Health Insurance Coverage doesn’t have to be stressful. Learn how to compare premiums, deductibles, networks, and benefits with a clear checklist.

Stay Healthy | Preventive Coverage & Wellness

Learn how using health insurance to stay healthy can improve well-being, lower costs, & support preventive care with Vivna Insurance.

Open Enrollment: Your Complete Guide to Health Insurance

Learn how Open Enrollment 2026 works, what changes to expect, and how Vivna Insurance can help you compare options including ACA, supplemental, and alternative plans.

Understanding Health Insurance Subsidies | Vivna Insurance

Discover how health insurance subsidies help make coverage more affordable. Vivna Insurance explains subsidy eligibility, plan options, and how to save the most on your healthcare costs.

Short-term vs ACA

Short term vs ACA : Compare costs, coverage, subsidies. Find the best plan for you. Free quote: 888-730-6001.

Life vs Health Insurance: Which Do You Need?

Take our 2-min quiz to see if you need life insurance, health insurance, or both in 2026. Free quote: 888-730-6001.

Best Health Insurance 2026 Nationwide – Save Up to $1,500/Month

Compare top health insurance 2026 nationwide. ACA, short-term, dental, life plans. Save with subsidies. Free quote: 888-730-6001.

Open Enrollment Guide – Save $1,200+ on Health Insurance

Open Enrollment 2026 starts Nov 1. Save $1,200+ on ACA health insurance with Vivna. Free quotes from UnitedHealthcare & more. Call 888-730-6001.

Open Enrollment 2026 | Affordable Health, Dental & Vision, Supplemental & Short-Term Plans

Open Enrollment 2026 is here. Explore affordable health insurance, dental and vision options, supplemental, short-term and tri-term plans. Vivna can help you compare coverage, apply for subsidies, and save. Call 888-730-6001.

Healthcare Expenses in Early Retirement: What to Expect and How to Save

Healthcare costs can surprise early retirees. Learn how to plan ahead, build savings, and explore insurance options to protect your financial future.

Planning for Retirement and Increased Life Expectancy | Vivna

People are living longer than ever—make sure you’re financially and medically prepared. Learn six essential steps for planning for retirement and increased life expectancy, from budgeting to health coverage, with Vivna Insurance.

What is Supplemental Insurance Coverage, and When to Buy It.

Supplemental insurance coverage can help cover medical expenses your primary health plan does not. Learn how these affordable add-on policies protect families from unexpected costs.

How to Get the Most Out of Your Health Insurance in 2026 | Complete Guide

Learn how to get the most out of your health insurance in 2026 by maximizing benefits, improving coverage use, and saving money.

12 Key Factors In Choosing Health, Dental And Vision Insurance

Learn the key factors in choosing health, dental, and vision insurance, including networks, costs, benefits, and how to confidently select the right plan.

Guide to Choosing a Primary Care Doctor

Use this step-by-step guide to choose a primary care doctor who fits your plan and needs.

Why Health Insurance is Paramount with All the Natural Disasters We Are Facing?

Learn why insurance coverage matters for your health, home, and financial security.

Using Telehealth Services

Explore the advantages and disadvantages of telehealth services and learn how virtual care can improve access, convenience, and healthcare affordability.

Health Insurance Options

Learn about the most important health insurance options available, including private plans, employer coverage, ACA Marketplace options, and supplemental protection.

The Top 3 Things You Need To Know About Buying Health Insurance!

Learn the essential steps for choosing health insurance plans, comparing policies, and protecting your long-term financial and medical needs.