Affordable Health Insurance Options

Vivna Insurance

Finding affordable health insurance does not have to feel overwhelming. Vivna Insurance helps individuals, families, and self-employed professionals compare health insurance options, private medical coverage, and Marketplace plans so they can choose coverage with confidence and clarity.

VIVNA ONLY WORKS WITH

CARRIERS YOU CAN TRUST

Understanding Supplemental, Dental & Vision, and Life Insurance

Supplemental Insurance

Supplemental insurance helps strengthen coverage gaps by providing additional financial protection when medical events occur. Because many households benefit from flexible support beyond standard medical plans, these options are often used to help manage out-of-pocket costs and unexpected expenses. Vivna Insurance helps explain how supplemental coverage works so you can decide whether it fits your overall health insurance strategy.

Dental & Vision

Dental and vision insurance help support routine care while protecting against unexpected out-of-pocket expenses. These plans are commonly used to manage costs for exams, cleanings, imaging, eyewear, and corrective lenses. Vivna Insurance helps explain how dental and vision coverage fits alongside medical plans so families can maintain everyday wellness with greater confidence.

Life Insurance

Life insurance provides long-term financial protection designed to support your family’s future. These policies are commonly used to help replace income, cover outstanding obligations, and offer stability during unexpected life events. Vivna Insurance helps explain how life insurance works and how it can complement your overall coverage strategy.

Frequently Asked Questions

Q: What does ACA Marketplace Health Insurance cover, and who qualifies?

ACA Marketplace Health Insurance provides essential medical coverage that includes preventive care, primary care, emergency services, and federally regulated benefits. Because eligibility is broad, most U.S. residents who are not enrolled in Medicare can qualify. These plans also offer subsidies that help reduce costs, making Marketplace coverage ideal for individuals and families seeking reliable, affordable Health Insurance options.

Q: When is Short-Term or Tri-Term Health Insurance a good option?

Short-Term and Tri-Term Health Insurance is helpful when you need temporary medical coverage during job transitions, waiting periods, or gaps between major plans. These policies often cost less, although they do not include full ACA benefits. Therefore, they work best for people who need flexible, immediate Health Insurance support until long-term coverage begins.

Q: Why should I add Dental & Vision Insurance to my Health Insurance plan?

Dental & Vision Insurance helps cover essential care such as exams, cleanings, eye evaluations, and treatment for common dental or vision issues. Since most Health Insurance plans do not include these services, adding Dental & Vision benefits ensures better wellness support and reduces out-of-pocket costs for routine care.

Q: What does Supplemental Insurance cover that standard Health Insurance does not?

Supplemental insurance provides additional financial support for events such as accidents, hospital stays, critical illnesses, and other unexpected medical situations. Because standard medical coverage may leave certain out-of-pocket expenses uncovered, these plans can offer cash benefits that help families manage costs with greater confidence and flexibility.

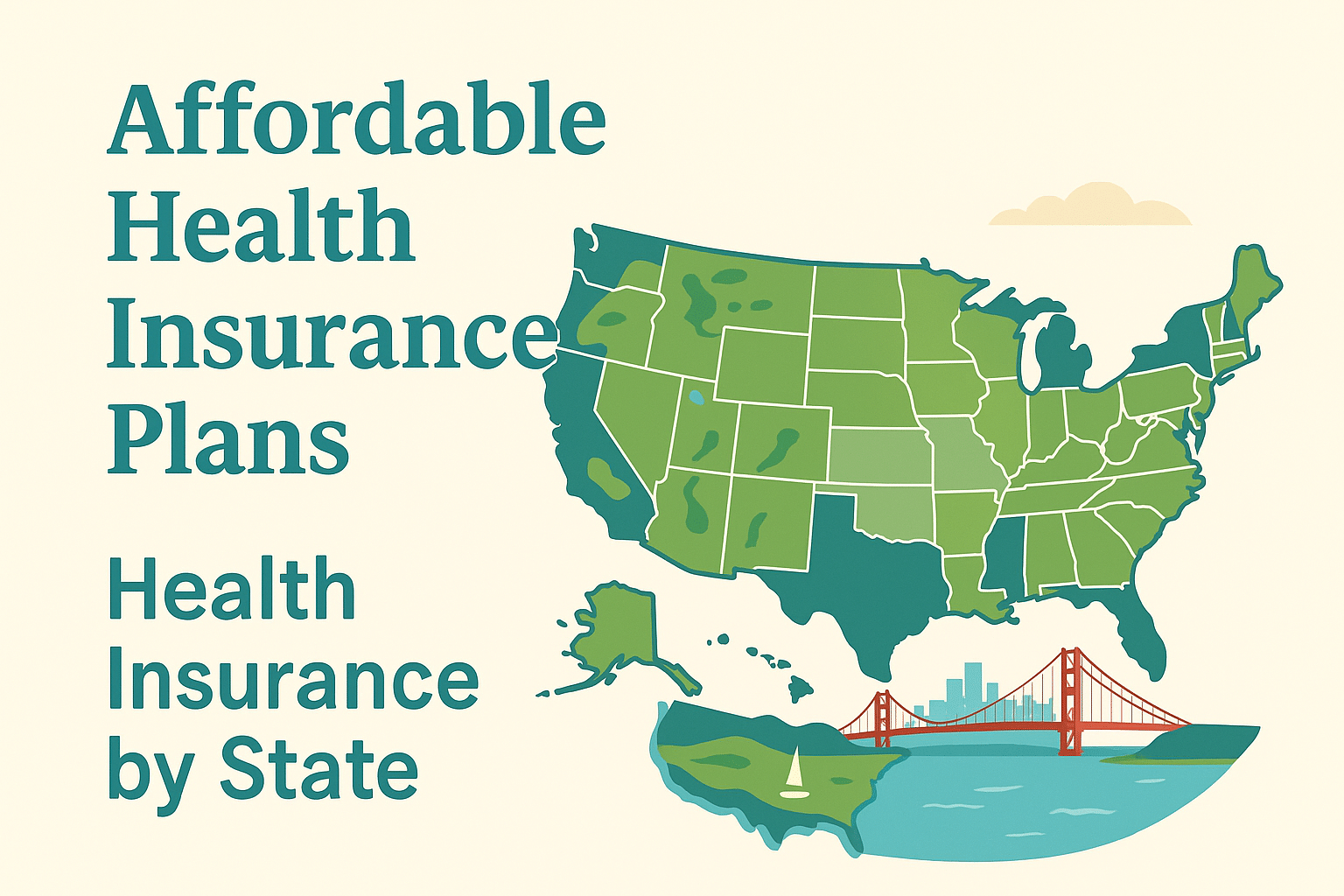

Alabama

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

Nevada

New Hamp.

New Jersey

New Mexico

New York

North Carolina

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

South Dakota

Tennessee

Contact Vivna Insurance

888-730-6001

To complete the form below to request your personalized insurance review.

Get a Free Quote

For additional information about dental and vision care, you can explore trusted health resources such as the

National Institutes of Health (NIH) and the Centers for Disease Control and Prevention (CDC).

Vivna Insurance helps individuals and families compare coverage options, including Supplemental Insurance,

to support a well-rounded insurance strategy. To explore all coverage options and resources, visit the Vivna Insurance home page

or browse the latest guides in the Vivna Insurance Blog.

Health & Insurance Blog Insights

Healthcare Expenses in Early Retirement: What to Expect and How to Save

Healthcare costs can surprise early retirees. Learn how to plan ahead, build savings, and explore insurance options to protect your financial future.

What is Supplemental Insurance and When to Buy It?

Learn what supplemental insurance coverage is, how it fills financial gaps, and when families should consider purchasing it.

What is Supplemental Insurance Coverage, and When to Buy It.

Supplemental insurance coverage can help cover medical expenses your primary health plan does not. Learn how these affordable add-on policies protect families from unexpected costs.

How to Get the Most Out of Your Health Insurance in 2026 | Complete Guide

Learn how to get the most out of your health insurance in 2026 by maximizing benefits, improving coverage use, and saving money.

12 Key Factors In Choosing Health, Dental And Vision Insurance

Learn the key factors in choosing health, dental, and vision insurance, including networks, costs, benefits, and how to confidently select the right plan.

Vision Insurance Coverage — What It Is and Why It Matters

Learn how vision insurance coverage works, what it includes, and why eye exams, glasses, and lenses are essential to long-term wellness.

Why Over the Road & Long Haul Truck Drivers Need Good Health Insurance

Learn why health insurance for truck drivers is important and how coverage supports long-term wellness.

Guide to Choosing a Primary Care Doctor

Use this step-by-step guide to choose a primary care doctor who fits your plan and needs.

Why Health Insurance is Paramount with All the Natural Disasters We Are Facing?

Learn why insurance coverage matters for your health, home, and financial security.

Losing Job Health Insurance Options | Vivna Insurance

Learn practical losing job health insurance options to stay covered, compare COBRA vs ACA, and use short-term bridges with Vivna’s guidance.

Using Telehealth Services

Explore the advantages and disadvantages of telehealth services and learn how virtual care can improve access, convenience, and healthcare affordability.

Exercise and long-term benefits

Discover how exercise and long-term benefits improve your health, support better habits, and help you secure more affordable insurance options.