Why Choose Tri-Term Health Insurance

Tri-term health insurance offers temporary medical coverage structured for longer coverage periods during life transitions.

Longer Temporary Coverage Structure

Tri-term insurance is designed to provide temporary medical coverage over a longer defined period, making it useful for extended transitions.

Coverage During Life Changes

Tri-term insurance can help maintain medical coverage when you are between jobs, relocating, or navigating other major life events.

Predictable Coverage Timeframe

Tri-term health insurance offers a clearly defined coverage period, which can help with planning before long-term insurance begins.

Access to Core Medical Benefits

Tri-term health insurance may include benefits such as doctor visits, emergency care, and hospitalization, depending on plan design.

Option Outside Enrollment Windows

Tri term health insurance can be considered when traditional enrollment periods are closed, and long-term plans are not immediately available.

Temporary Alternative to Long-Term Plans

Tri-term insurance is intended to provide interim medical coverage without committing to a permanent policy.

All-Access Guidance for Tri-Term Health Insurance

Clear explanations, plan education, and help understanding coverage options—without pressure.

For Individuals

Get help understanding tri-term insurance options, coverage timeframes, and eligibility during extended transitions between health plans.

For Families

Receive guidance on how tri-term insurance may support temporary household coverage needs while planning long-term insurance solutions.

Frequently Asked Questions About Tri-Term Health Insurance

What is tri-term health insurance?

Tri-term health insurance is a type of temporary medical coverage designed to provide coverage over a defined, longer transition period when long-term health plans are not yet in place.

Who should consider tri-term health insurance?

Tri-term health insurance may be considered by individuals or families experiencing extended life transitions, such as employment changes or delayed access to long-term coverage.

How long does tri-term health insurance coverage last?

Coverage length varies by plan and state rules, but tri-term health insurance is structured to provide coverage for a defined temporary period rather than permanent coverage.

What types of medical services may be covered under a tri-term health insurance plan?

Depending on the plan, tri-term health insurance may include benefits such as doctor visits, emergency care, hospitalization, and other medical services outlined in the policy.

Does tri-term health insurance cover pre-existing conditions?

Coverage for pre-existing conditions varies by plan and may include limitations or exclusions, making it important to review policy details carefully.

Is tri-term health insurance a replacement for long-term health insurance?

Tri-term health insurance is not intended to replace long-term or comprehensive health insurance, but may help bridge coverage gaps during temporary situations.

Contact Vivna Insurance

888-730-6001

To complete the form below to request your personalized insurance review.

Get a Free Quote

For additional information about dental and vision care, you can explore trusted health resources such as the

National Institutes of Health (NIH) and the Centers for Disease Control and Prevention (CDC).

Vivna Insurance helps individuals and families compare coverage options, including Supplemental Insurance,

to support a well-rounded insurance strategy. To explore all coverage options and resources, visit the Vivna Insurance home page

or browse the latest guides in the Vivna Insurance Blog.

Health & Insurance Blog Insights

Key Factors in Choosing Health Dental and Vision Insurance

Learn key factors in choosing health dental and vision insurance, including costs, provider networks, and coverage benefits.

Affordable Health Insurance Provider | Coverage Guide & Plan Comparison

Learn how to evaluate an Affordable Health Insurance Provider, compare coverage types, and choose plans that protect your health and budget.

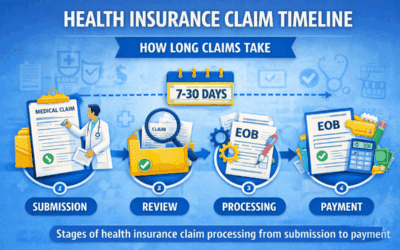

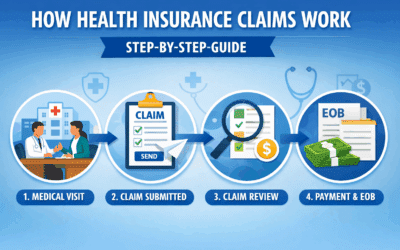

Health Insurance Claim Timeline | How Long Claims Take

Learn the Health Insurance Claim Timeline so you know how long claims take and what causes delays.

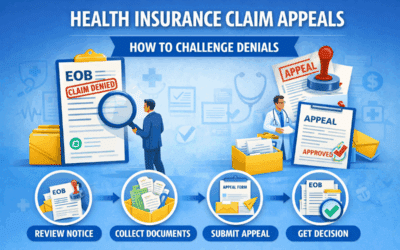

Health Insurance Claim Appeals | How to Challenge Denials

Learn how Health Insurance Claim Appeals work so you can challenge denied claims, provide documentation, and improve approval chances.

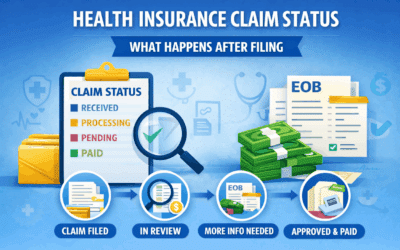

Health Insurance Claim Status | What Happens After Filing

Learn what Health Insurance Claim Status updates mean after filing and how to move a pending claim forward faster.

Health Insurance Claims Process | Step-By-Step Guide

Understand the Health Insurance Claims Process step by step so you can manage medical bills and avoid payment surprises.

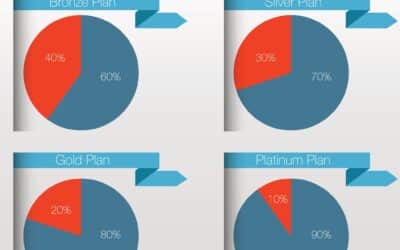

Understanding Health Insurance Coverage | What Plans Include and How Benefits Work

A detailed guide to understanding health insurance coverage, including covered services, networks, exclusions, and cost-related rules.

Health Insurance Cost Breakdown Guide

A detailed guide explaining health insurance costs, including premiums, deductibles, copays, coinsurance, and out-of-pocket maximums.

Understanding Health Insurance Enrollment

A detailed guide explaining health insurance enrollment, including timing, eligibility, and how to avoid coverage gaps.

Understanding Supplemental Coverage Options

A detailed guide explaining supplemental coverage options and how they help reduce medical out-of-pocket costs.