Welcome to Vivna Insurance of South Carolina

South Carolina Health Insurance helps protect your health and financial security. At Vivna Insurance, we help individuals, families, and small businesses compare affordable plan options so they can choose coverage with confidence.

Request your free quote today.

A licensed agent will contact you shortly.

“Licensed agents • Free plan comparisons • No obligation”

Understanding South Carolina Health Insurance Options

Choosing the right South Carolina Health Insurance is an important step toward protecting both your health and your finances. Vivna Insurance helps residents compare affordable plan options, understand coverage levels, and select benefits that align with their healthcare needs, budget, and preferred providers.

Plan choices vary based on monthly premiums, deductibles, provider networks, and covered services. Many South Carolina residents qualify for ACA Marketplace savings, and our licensed agents simplify the process by explaining plan tiers, reviewing eligibility, and providing clear guidance so you can confidently choose the right coverage.

South Carolina Health Insurance FAQs

What does South Carolina Health Insurance typically cover?

Most South Carolina Health Insurance plans cover essential medical services such as doctor visits, hospital care, preventive screenings, prescription medications, maternity services, and mental health treatment. Coverage details vary depending on the provider network, deductible level, and included benefits. Many residents compare plan tiers to balance monthly premium costs with expected out-of-pocket healthcare expenses.

How much does South Carolina Health Insurance cost per month?

The cost of South Carolina Health Insurance depends on several factors including age, location, household size, income level, and plan tier. Many South Carolina residents qualify for ACA Marketplace subsidies that can significantly reduce monthly premiums. Comparing multiple plan options helps ensure you select coverage that fits both your healthcare needs and budget.

Can I get financial assistance for South Carolina Health Insurance?

Yes, many South Carolina residents qualify for income-based tax credits that help lower the cost of South Carolina Health Insurance. These subsidies reduce monthly premium payments and may also lower deductibles and out-of-pocket expenses. Eligibility is determined based on household income and family size.

When can I enroll in a South Carolina Health Insurance plan?

You can enroll in South Carolina Health Insurance during the annual Open Enrollment Period. You may also qualify for a Special Enrollment Period if you experience a qualifying life event such as losing coverage, moving, getting married, or having a child. Enrolling on time helps ensure continuous coverage.

Do South Carolina Health Insurance plans cover preventive care services?

Most ACA-compliant South Carolina Health Insurance plans cover preventive services such as annual checkups, screenings, and certain vaccinations at no additional cost when using in-network providers. Preventive care helps detect potential health issues early and supports long-term wellness.

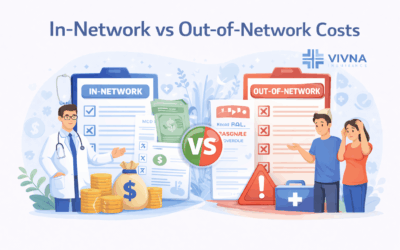

How do provider networks affect South Carolina Health Insurance costs?

Provider networks significantly impact South Carolina Health Insurance costs because they determine which doctors and hospitals offer lower in-network rates. Choosing in-network providers helps minimize out-of-pocket expenses and ensures access to covered healthcare services at the most affordable level.

Contact Vivna Insurance

888-730-6001

To complete the form below to request your personalized insurance review.

Get a Free Quote

For additional information about dental and vision care, you can explore trusted health resources such as the

National Institutes of Health (NIH) and the Centers for Disease Control and Prevention (CDC).

Vivna Insurance helps individuals and families compare coverage options, including Supplemental Insurance,

to support a well-rounded insurance strategy. To explore all coverage options and resources, visit the Vivna Insurance home page

or browse the latest guides in the Vivna Insurance Blog.

Health Insurance Blog

Understanding Dental Vision Insurance

A clear guide to understanding dental vision insurance, including coverage structure, benefits, and how to choose the right plan.

Understanding Health Insurance Basics

A clear guide to understanding health insurance basics, including coverage structure, enrollment rules, and plan selection.

How Health Insurance Costs Change After Major Life Events

Health insurance cost changes often happen after major life events such as marriage, job changes, or relocation.

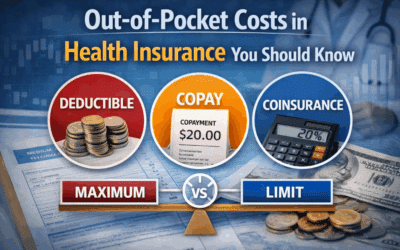

Out-of-Pocket Costs in Health Insurance You Should Know

Out-of-pocket health insurance costs include deductibles, copays, coinsurance, and maximum limits that affect total spending.

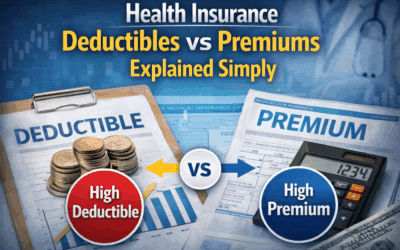

Health Insurance Deductibles vs Premiums Explained Simply

Health insurance deductibles premiums affect both monthly costs and out-of-pocket expenses when care is needed.

What Affects Your Monthly Health Insurance Premium

Several factors affect your monthly health insurance premium, including coverage design, networks, benefits, and location.

Why Health Insurance Costs Vary So Much | Vivna Insurance

Health insurance costs vary so much due to coverage levels, deductibles, networks, and regional pricing differences.

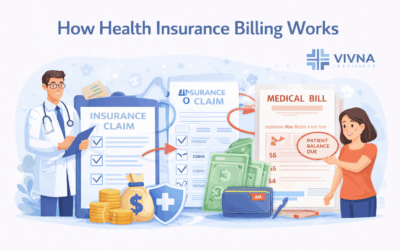

How Health Insurance Billing Works

Learn how health insurance billing works, including claims, EOBs, and patient responsibility after care.

In-Network vs Out-of-Network Costs

Learn the difference between in-network and out-of-network costs and how provider networks affect your healthcare expenses.

What Is an Out-of-Pocket Maximum

Learn what an out-of-pocket maximum is and how it protects you from high medical costs when using health insurance.