Open Enrollment is Here, And It's Time to Start Shooping for Health Insurance.

Open Enrollmemt starts in

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

To Speak With A Vivna Agent About Plan Options Please Fill Out The Form Below

If you have recently experienced a qualifying life event, you may be eligible for a Special Enrollment Period outside of open enrollment. Qualifying events can include losing job-based coverage, moving to a new area, having a child, getting married, or experiencing a change in household income. Vivna Insurance helps individuals and families understand their health insurance options and determine eligibility for special enrollment. Call 888-730-6001 to speak with a licensed agent and see if you qualify today.

Key Open Enrollment Health Insurance Topics to Review

How Vivna Helps You Navigate Open Enrollment Options

Vivna Insurance helps simplify Open Enrollment by guiding individuals through available health insurance options. Licensed agents assist with plan comparisons, coverage explanations, and enrollment support. This personalized approach helps ensure you select health insurance coverage with confidence and clarity.

Understanding Open Enrollment Health Insurance Options

During Open Enrollment, individuals and families can review available health insurance plans and make changes to their coverage. Options may include different plan types, coverage levels, and provider networks. Understanding how these choices compare helps ensure your health insurance aligns with your medical needs and budget.

How Health Insurance Plans Differ During Open Enrollment

Health insurance plans can vary in monthly premiums, deductibles, copayments, and out-of-pocket costs. During Open Enrollment, it’s important to compare how each plan handles doctor visits, prescriptions, and hospital care. Reviewing these differences allows you to choose coverage that fits both your healthcare usage and financial goals.

Who Should Review Coverage During Open Enrollment

Open Enrollment is especially important for individuals experiencing changes in healthcare needs, income, or household size. Even if your situation hasn’t changed, reviewing your health insurance annually can uncover better coverage options or cost-saving opportunities. This review ensures your plan continues to meet your needs for the year ahead.

Frequently Ask Questions About the Open Enrollment Period

What is Open Enrollment for health insurance?

Open Enrollment is the period when individuals and families can enroll in a new health insurance plan or make changes to existing coverage. Outside of this period, changes are usually limited unless a qualifying life event occurs.

Do I need to enroll again if I already have health insurance?

In many cases, yes. Even if you are currently enrolled, reviewing your plan during Open Enrollment helps ensure your coverage, costs, and provider network still meet your needs. Some plans may change benefits or pricing.

What happens if I miss Open Enrollment?

If you miss Open Enrollment, you may not be able to enroll in or change health insurance coverage unless you qualify for a Special Enrollment Period due to a life event such as job loss, moving, or a change in household size.

What types of health insurance plans are available during Open Enrollment?

During Open Enrollment, individuals can compare various health insurance options, including Marketplace plans and private coverage. Plans may differ in premiums, deductibles, coverage levels, and provider access.

What qualifies someone for a Special Enrollment Period?

Qualifying events may include losing job-based coverage, getting married, having a child, moving to a new area, or experiencing a significant change in income. These events may allow you to enroll outside Open Enrollment.

Can I change health insurance plans if my income changes?

Yes, certain income changes may qualify you for a Special Enrollment Period. Adjusting your coverage can help ensure your plan remains affordable and appropriate for your situation.

How do I know which health insurance plan is right for me?

The right plan depends on factors such as healthcare usage, budget, preferred doctors, and prescription needs. Comparing coverage details during Open Enrollment helps you make an informed decision.

How can Vivna Insurance help during Open Enrollment?

Vivna Insurance connects individuals with licensed agents who help explain health insurance options, compare plans, and assist with enrollment. This support helps make Open Enrollment easier and more manageable.

Contact Vivna Insurance

888-730-6001

To complete the form below to request your personalized insurance review.

Get a Free Quote

For additional information about dental and vision care, you can explore trusted health resources such as the

National Institutes of Health (NIH) and the Centers for Disease Control and Prevention (CDC).

Vivna Insurance helps individuals and families compare coverage options, including Supplemental Insurance,

to support a well-rounded insurance strategy. To explore all coverage options and resources, visit the Vivna Insurance home page

or browse the latest guides in the Vivna Insurance Blog.

Health & Insurance Blog Insights

Understanding Health Insurance Basics

A clear guide to understanding health insurance basics, including coverage structure, enrollment rules, and plan selection.

How Health Insurance Costs Change After Major Life Events

Health insurance cost changes often happen after major life events such as marriage, job changes, or relocation.

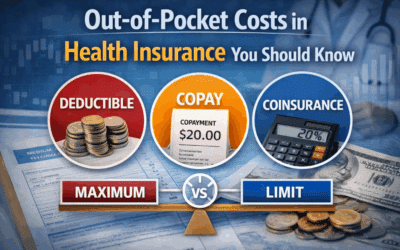

Out-of-Pocket Costs in Health Insurance You Should Know

Out-of-pocket health insurance costs include deductibles, copays, coinsurance, and maximum limits that affect total spending.

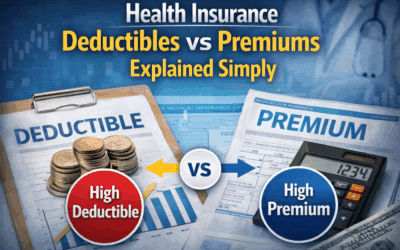

Health Insurance Deductibles vs Premiums Explained Simply

Health insurance deductibles premiums affect both monthly costs and out-of-pocket expenses when care is needed.

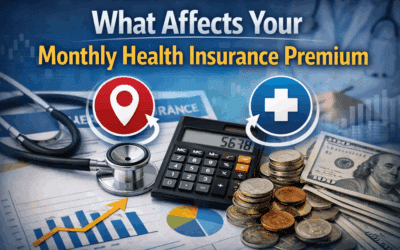

What Affects Your Monthly Health Insurance Premium

Several factors affect your monthly health insurance premium, including coverage design, networks, benefits, and location.

Why Health Insurance Costs Vary So Much | Vivna Insurance

Health insurance costs vary so much due to coverage levels, deductibles, networks, and regional pricing differences.

How Health Insurance Billing Works

Learn how health insurance billing works, including claims, EOBs, and patient responsibility after care.

In-Network vs Out-of-Network Costs

Learn the difference between in-network and out-of-network costs and how provider networks affect your healthcare expenses.

What Is an Out-of-Pocket Maximum

Learn what an out-of-pocket maximum is and how it protects you from high medical costs when using health insurance.