Ready to Get Your Free Quote Today?

We Have Agents Ready To Take Your Call Get a Free QuoteWant To Review Your OptionsWelcome to Vivna Insurance of New York

New York Health Insurance helps protect your health and financial security. At Vivna Insurance, we help individuals, families, and small businesses compare affordable plan options so they can choose coverage with confidence.

Request your free quote today.

A licensed agent will contact you shortly.

“Licensed agents • Free plan comparisons • No obligation”

Why Choose Vivna Insurance

Vivna Insurance provides personalized guidance across health, life, dental, vision, and supplemental coverage, helping individuals and families choose plans that truly fit their needs. 🤝

Because Vivna is licensed nationwide and appointed with major carriers, clients gain access to multiple options with expert support every step of the way. 🌎📋

Personalized Support

Our team takes the time to understand your doctors, budget, and coverage goals so we can recommend the plans that work best for you.

Nationwide Coverage

Whether you’re looking for local options or nationwide plans, Vivna helps you explore a wide range of insurance choices in your state.

Choose Your Carrier

We work with trusted carriers including UnitedHealthcare, Pivot Health, Oscar, Aflac, and others to provide competitive plan options.

Clear, Simple Guidance

We walk you through every step—from comparing plans to selecting coverage—so you always feel confident in your choice.

Understanding New York Health Insurance Options

Choosing the right New York Health Insurance is essential for managing medical expenses and accessing trusted healthcare providers. Vivna Insurance helps residents compare plans and understand coverage levels to make informed decisions.

Plans vary based on premiums, deductibles, networks, and covered services. Many residents qualify for Marketplace savings, and our licensed agents simplify plan selection to ensure confident coverage choices.

New York Health Insurance FAQs

What does New York Health Insurance cover?

Most plans cover essential services including medical visits, hospitalization, prescriptions, preventive care, and mental health treatment.

How much does coverage cost in New York?

Costs vary based on income, age, plan tier, and provider network.

Can I get financial assistance?

Yes. Many residents qualify for subsidies that reduce monthly premiums.

When can I enroll?

Enrollment happens annually or after qualifying life events.

Are preventive services included?

Yes. Preventive care is typically covered at no cost in-network.

How do provider networks affect costs?

Networks determine provider availability and out-of-pocket expenses.

Contact Vivna Insurance

888-730-6001

To complete the form below to request your personalized insurance review.

Get a Free Quote

For additional information about dental and vision care, you can explore trusted health resources such as the

National Institutes of Health (NIH) and the Centers for Disease Control and Prevention (CDC).

Vivna Insurance helps individuals and families compare coverage options, including Supplemental Insurance,

to support a well-rounded insurance strategy. To explore all coverage options and resources, visit the Vivna Insurance home page

or browse the latest guides in the Vivna Insurance Blog.

Health & Insurance Blog Insights

Key Factors in Choosing Health Dental and Vision Insurance

Learn key factors in choosing health dental and vision insurance, including costs, provider networks, and coverage benefits.

Affordable Health Insurance Provider | Coverage Guide & Plan Comparison

Learn how to evaluate an Affordable Health Insurance Provider, compare coverage types, and choose plans that protect your health and budget.

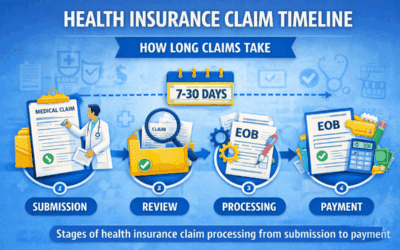

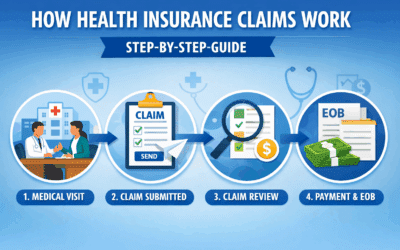

Health Insurance Claim Timeline | How Long Claims Take

Learn the Health Insurance Claim Timeline so you know how long claims take and what causes delays.

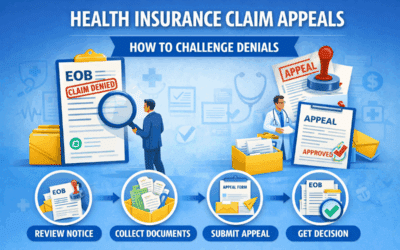

Health Insurance Claim Appeals | How to Challenge Denials

Learn how Health Insurance Claim Appeals work so you can challenge denied claims, provide documentation, and improve approval chances.

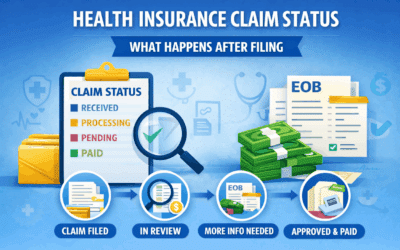

Health Insurance Claim Status | What Happens After Filing

Learn what Health Insurance Claim Status updates mean after filing and how to move a pending claim forward faster.

Health Insurance Claims Process | Step-By-Step Guide

Understand the Health Insurance Claims Process step by step so you can manage medical bills and avoid payment surprises.

Understanding Health Insurance Coverage | What Plans Include and How Benefits Work

A detailed guide to understanding health insurance coverage, including covered services, networks, exclusions, and cost-related rules.

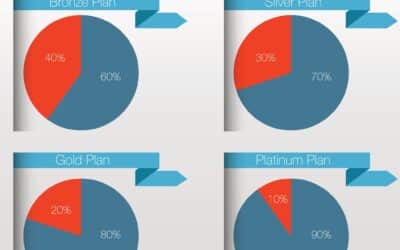

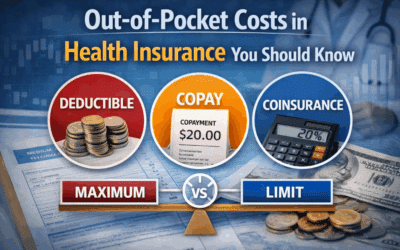

Health Insurance Cost Breakdown Guide

A detailed guide explaining health insurance costs, including premiums, deductibles, copays, coinsurance, and out-of-pocket maximums.

Understanding Health Insurance Enrollment

A detailed guide explaining health insurance enrollment, including timing, eligibility, and how to avoid coverage gaps.

Understanding Supplemental Coverage Options

A detailed guide explaining supplemental coverage options and how they help reduce medical out-of-pocket costs.

Understanding Dental Vision Insurance

A clear guide to understanding dental vision insurance, including coverage structure, benefits, and how to choose the right plan.

Understanding Health Insurance Basics

A clear guide to understanding health insurance basics, including coverage structure, enrollment rules, and plan selection.

How Health Insurance Costs Change After Major Life Events

Health insurance cost changes often happen after major life events such as marriage, job changes, or relocation.

Out-of-Pocket Costs in Health Insurance You Should Know

Out-of-pocket health insurance costs include deductibles, copays, coinsurance, and maximum limits that affect total spending.

Health Insurance Deductibles vs Premiums Explained Simply

Health insurance deductibles premiums affect both monthly costs and out-of-pocket expenses when care is needed.

What Affects Your Monthly Health Insurance Premium

Several factors affect your monthly health insurance premium, including coverage design, networks, benefits, and location.

Why Health Insurance Costs Vary So Much | Vivna Insurance

Health insurance costs vary so much due to coverage levels, deductibles, networks, and regional pricing differences.

How Health Insurance Billing Works

Learn how health insurance billing works, including claims, EOBs, and patient responsibility after care.

In-Network vs Out-of-Network Costs

Learn the difference between in-network and out-of-network costs and how provider networks affect your healthcare expenses.

What Is an Out-of-Pocket Maximum

Learn what an out-of-pocket maximum is and how it protects you from high medical costs when using health insurance.

What Is a Health Insurance Premium

Learn what a health insurance premium is, how it affects total costs, and how to compare plans confidently.