Molina Healthcare

Molina Healthcare Plans provide dependable, budget-friendly coverage that helps individuals and families access essential care with confidence and clarity.

You’re One Click Away from your Molina Healthcare quote.

Molina Healthcare delivers affordable, high-quality health coverage designed to support individuals and families with reliable benefits.

Compare Molina Healthcare Plans

Explore affordable Molina Healthcare Plans tailored to your doctors, budget, and coverage needs

Check Your Eligibility & Savings

Call to check your eligibility for lower premiums and Marketplace subsidies with Molina Healthcare plans.

Get a Personalized Molina Quote

Get personalized Molina Healthcare pricing and plan options in minutes from our licensed agents.

Molina Healthcare Services

Molina Healthcare Plans give you access to a wide range of essential health services designed to support your care at every stage of life. From primary care and preventive screenings to specialized treatment and women’s health services, Molina delivers dependable, compassionate coverage that helps you stay healthy and protected. Our goal is to make it easier for individuals and families to find affordable, high-quality care within a trusted provider network.

Family Medicine

Molina Healthcare Plans include Family Medicine services that help you manage everyday health needs with confidence. These visits support checkups, preventive care, chronic condition guidance, and trusted treatment options for all ages.

Pregnancy

Molina Healthcare Plans offer Pregnancy support services that help expectant parents access essential care with confidence. These visits include screenings, guidance, prenatal monitoring, and trusted resources for a healthy pregnancy journey.

Women's Health

Molina Healthcare Plans provide Women’s Health services that support preventive care, routine screenings, and essential wellness guidance. These visits help women manage their health needs with confidence and access trusted care at every stage of life.

Orthopedics

Molina Healthcare Plans include Orthopedic services that support joint care, injury treatment, and mobility improvement. These visits help individuals manage pain, recover safely, and access trusted specialists for long-term bone and muscle health.

Pediatrics

Molina Healthcare Plans offer Pediatrics services that support children’s health with preventive care, routine checkups, and early treatment guidance. These visits help families ensure their children stay healthy and receive trusted support at every stage.

Primary Care

Molina Healthcare Plans provide Primary Care services that support everyday health needs with preventive visits, routine checkups, and early treatment guidance. These visits help individuals stay healthy, manage concerns confidently, and access trusted care when needed.

Frequently Asked Questions About Molina Healthcare Plans

1. What do Molina Healthcare Plans typically cover?

Molina Healthcare Plans usually cover essential health benefits such as doctor visits, preventive care, prescriptions, emergency services, mental health support, and chronic condition management. Coverage varies by state and plan level, but most members receive comprehensive benefits to support everyday healthcare needs.

2. How do I know if my doctor accepts Molina Healthcare?

You can check Molina’s provider network by reviewing their online directory or by contacting a licensed agent for assistance. Molina Healthcare Plans feature a large network of primary care doctors, specialists, clinics, and hospitals, helping you find trusted care close to home.

3. Are Molina Healthcare Plans available through the Health Insurance Marketplace?

Yes, many Molina Healthcare Plans are offered through the Marketplace and may qualify for subsidies that lower monthly premiums. Eligible individuals and families can often access affordable ACA-compliant coverage with essential benefits and preventive services.

4. How much do Molina Healthcare Plans cost?

Plan costs vary based on your location, income, household size, and the level of coverage you choose. Many members qualify for reduced premiums or cost-sharing assistance. A personalized quote will show your exact rates and available savings.

5. Can I get help choosing the right Molina Healthcare Plan?

Yes. Licensed agents can help compare benefits, check provider networks, confirm prescription coverage, and review pricing options. This guidance makes it easier to choose a Molina Healthcare Plan that fits your health needs and budget.

For more tips on choosing coverage, understanding networks, and getting the most from Molina Healthcare Plans, visit our Health Insurance Blog. Many families also consider added protection for out-of-pocket costs. You can explore these options on our Affordable Supplemental Insurance Plans page. If you want to compare Molina Healthcare Plans with other carriers and coverage types, visit our main Health Insurance page for a full overview. Vivna Insurance supports individuals and families nationwide with Molina Healthcare Plans and a wide range of coverage solutions. Learn more about our agency at Vivna Insurance.

Contact us

Call Us

888-730-6001

Email Us

memberservices@vivna.net

Our Location

1353 SW 26th Ave.

Deerfield Beach FL. 33442

Connect with a licensed agent for help comparing Molina Healthcare Plans, checking eligibility, and reviewing your best coverage options.

Request Quote

Health & Insurance Blog Insights

Understanding Dental Vision Insurance

A clear guide to understanding dental vision insurance, including coverage structure, benefits, and how to choose the right plan.

Understanding Health Insurance Basics

A clear guide to understanding health insurance basics, including coverage structure, enrollment rules, and plan selection.

How Health Insurance Costs Change After Major Life Events

Health insurance cost changes often happen after major life events such as marriage, job changes, or relocation.

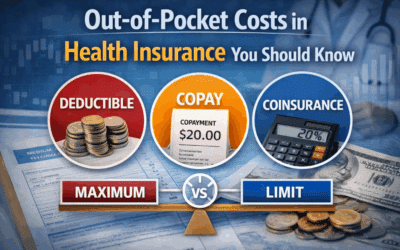

Out-of-Pocket Costs in Health Insurance You Should Know

Out-of-pocket health insurance costs include deductibles, copays, coinsurance, and maximum limits that affect total spending.

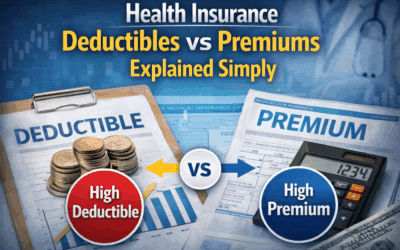

Health Insurance Deductibles vs Premiums Explained Simply

Health insurance deductibles premiums affect both monthly costs and out-of-pocket expenses when care is needed.

What Affects Your Monthly Health Insurance Premium

Several factors affect your monthly health insurance premium, including coverage design, networks, benefits, and location.

Why Health Insurance Costs Vary So Much | Vivna Insurance

Health insurance costs vary so much due to coverage levels, deductibles, networks, and regional pricing differences.

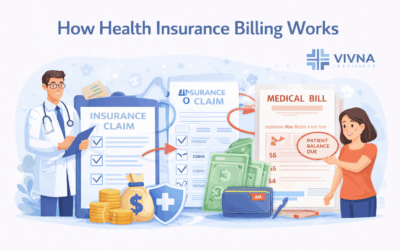

How Health Insurance Billing Works

Learn how health insurance billing works, including claims, EOBs, and patient responsibility after care.

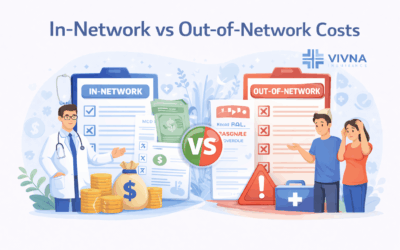

In-Network vs Out-of-Network Costs

Learn the difference between in-network and out-of-network costs and how provider networks affect your healthcare expenses.

What Is an Out-of-Pocket Maximum

Learn what an out-of-pocket maximum is and how it protects you from high medical costs when using health insurance.