Health Insurance Claims Process | Step-By-Step Guide

Understanding the Health Insurance Claims Process

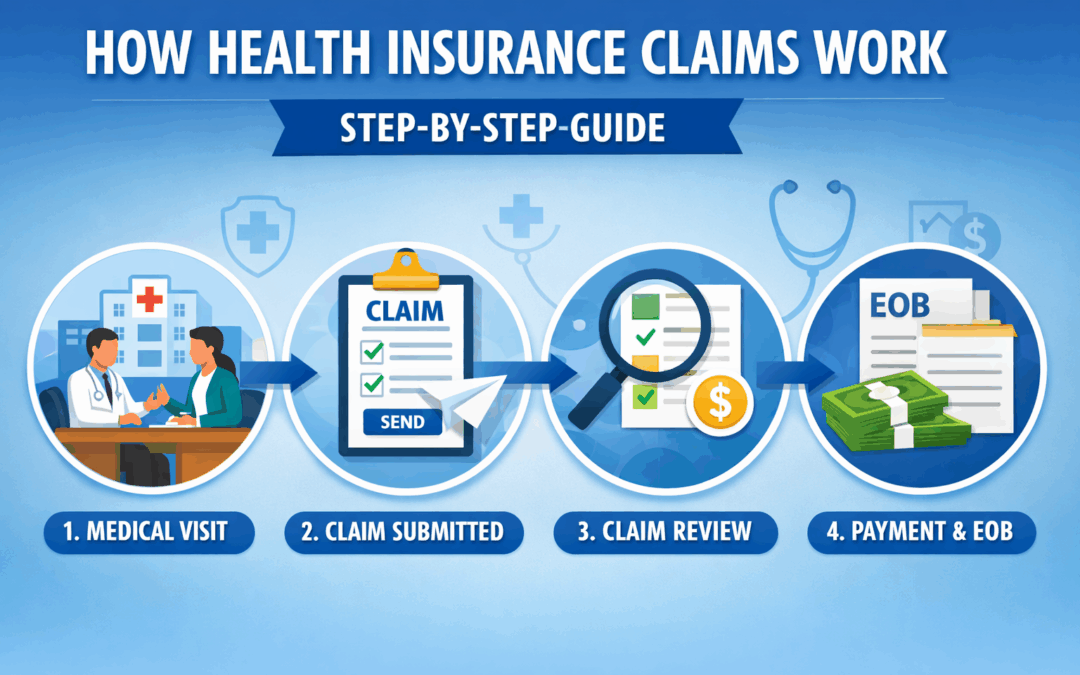

The health insurance coverage options you choose determine how the Health Insurance Claims Process works when you receive medical care. In simple terms, a claim is the request your healthcare provider sends to your insurance company asking for payment. Because every medical visit generates billing details, insurers use claims to verify coverage, apply benefits, and calculate what you owe. As a result, understanding this process helps you avoid surprises and manage healthcare costs more confidently.

Most people never see the steps happening behind the scenes. However, each claim follows a structured path from the provider’s office to final payment. Therefore, learning how the process works allows you to track claim status, catch errors early, and better understand your Explanation of Benefits.

Step 1: You Receive Medical Care

The Health Insurance Claims Process begins when you receive treatment from a doctor, hospital, or specialist. At that moment, the provider records your diagnosis, procedures performed, and billing codes. These standardized codes identify exactly what services you received and allow insurers to evaluate coverage quickly.

For example, preventive care, emergency treatment, and specialist visits each have unique codes. Consequently, insurance companies can immediately determine whether the service qualifies for payment under your plan benefits.

Step 2: The Provider Submits the Claim

After documenting your visit, the healthcare provider submits the claim directly to your insurance company. In most situations, providers send claims electronically, which speeds up processing significantly. Additionally, electronic submission reduces errors and helps insurers begin review faster.

Sometimes, you may need to submit a claim yourself. This usually happens when you receive out-of-network care. In those cases, you provide receipts and documentation so the insurer can evaluate the request.

Step 3: The Insurance Company Reviews the Claim

Once the insurer receives the claim, they begin a detailed review process. First, they verify that your policy was active on the service date. Next, they confirm whether the treatment qualifies under your coverage benefits. Finally, they apply deductibles, copays, and coinsurance requirements.

Because each plan has different cost-sharing rules, payment amounts vary between policies. Therefore, understanding your benefits helps you anticipate potential out-of-pocket expenses before treatment occurs.

Step 4: Payment Responsibility Is Calculated

After reviewing the claim, the insurer determines payment responsibility. Typically, they pay the healthcare provider directly for covered services. Meanwhile, you remain responsible for any deductible balance, copays, or non-covered charges.

Network status also plays an important role in payment decisions. For instance, in-network providers usually cost less because insurers negotiate discounted rates. As a result, choosing network providers often reduces your total healthcare expenses.

Step 5: You Receive an Explanation of Benefits

After processing finishes, the insurer sends you an Explanation of Benefits, commonly called an EOB. This document explains how the claim was handled. Importantly, it is not a bill but a summary showing payment details.

The EOB typically includes:

- Services provided

- Total billed charges

- Insurance payment amount

- Your remaining responsibility

Reviewing this document carefully helps you confirm accuracy and detect billing mistakes early.

Common Reasons Claims Experience Delays

Although most claims process smoothly, delays sometimes occur. Missing information, incorrect billing codes, or eligibility verification issues often cause these setbacks. However, providers and insurers usually resolve delays quickly once they receive additional documentation.

Therefore, keeping copies of medical records and insurance details helps you respond faster if questions arise.

Why Understanding the Claims Process Matters

Understanding the Health Insurance Claims Process empowers you to make smarter healthcare decisions. When you know how claims work, you can track payments, identify coverage gaps, and communicate effectively with providers. Additionally, this knowledge helps you choose plans that balance coverage and affordability.

Ultimately, claims knowledge gives you greater financial control and reduces stress during medical situations.

Frequently Asked Questions

How long does the claims process usually take?

Most claims process within 7 to 30 days, although complex cases may take longer.

Do patients normally file claims themselves?

Providers usually submit claims, but patients file them when they receive out-of-network services.

What should I do if a claim is denied?

You can request a review or submit an appeal with additional documentation to resolve most denials.

Contact Vivna Insurance for Help

If you need guidance understanding coverage or claims, Vivna Insurance can help. Our licensed agents explain plan details clearly so you can make confident healthcare decisions.

Call us at 888-730-6001 or visit our Health Insurance Blog for more educational resources.

For trusted health information, explore the National Institutes of Health and the Centers for Disease Control and Prevention.