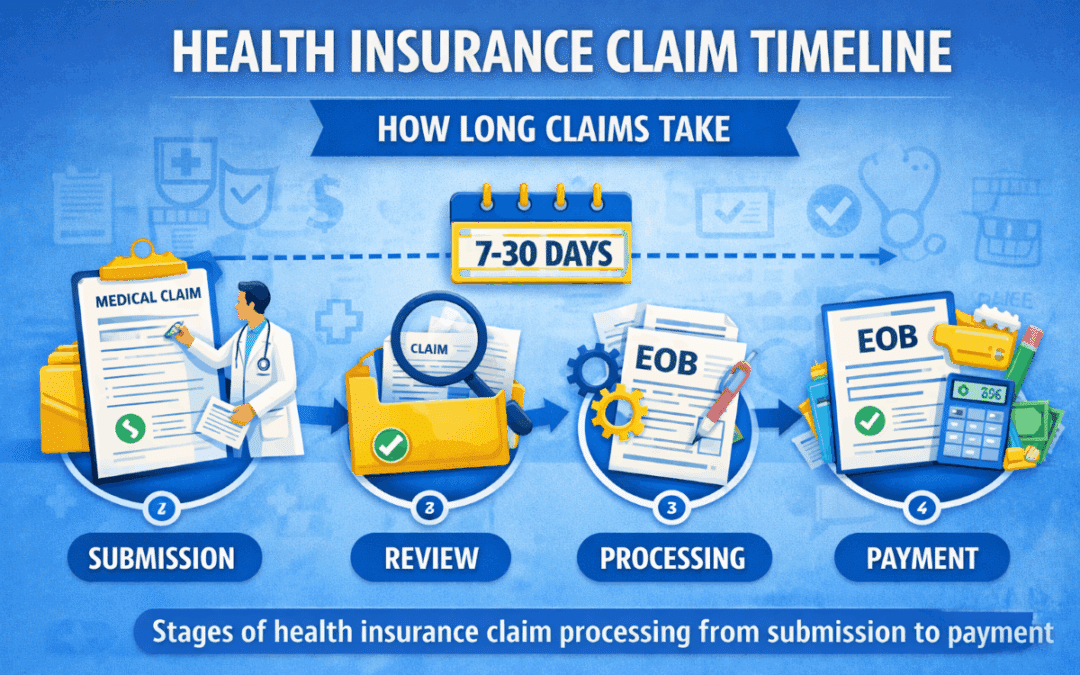

Health Insurance Claim Timeline | How Long Claims Take

Understanding the Health Insurance Claim Timeline

The Health Insurance Claim Timeline explains how long it usually takes for insurers to review and pay medical claims. Although many claims process quickly, timelines can vary depending on documentation, coverage rules, and provider submission accuracy. As a result, knowing what to expect helps you avoid unnecessary worry.

Most claims follow predictable stages. First, the provider submits the claim. Next, the insurer reviews coverage details. Finally, payment is issued and an Explanation of Benefits is generated. Therefore, understanding each stage helps you track progress confidently.

Typical Health Insurance Claim Processing Time

Most claims process within 7 to 30 days. However, simple in-network claims often complete faster because providers submit them electronically. Additionally, accurate coding allows insurers to approve claims without requesting extra information.

More complex claims, such as surgeries or out-of-network care, may take longer. Consequently, delays often occur when insurers need medical records or additional verification.

Stages of the Claim Timeline

Claim Submission

The timeline begins when your provider submits the claim. Electronic submissions typically reach insurers within a few days. Therefore, providers play a major role in starting the process efficiently.

Review and Processing

Next, insurers verify coverage, apply plan rules, and calculate cost-sharing. Because insurers must confirm eligibility and billing codes, this stage usually takes the most time.

Payment Determination

After completing the review, insurers determine payment responsibility. Typically, they pay providers directly while assigning remaining balances to patients.

Explanation of Benefits Issued

Finally, the insurer sends an Explanation of Benefits summarizing the claim outcome. Importantly, this document explains payments, adjustments, and any remaining balance.

Factors That Can Delay Claim Processing

Several factors can extend the Health Insurance Claim Timeline. Missing documentation, incorrect billing codes, and coverage verification issues often cause delays. Additionally, claims involving prior authorization or medical necessity reviews may require extra time.

However, most delays resolve quickly once providers submit the requested information.

How to Speed Up a Claim

You can help move claims forward by confirming provider network status, verifying authorization requirements, and keeping copies of medical documents. Additionally, contacting the provider’s billing office early helps identify issues before they become delays.

If you need help understanding how claims work, you can review guidance through Vivna health insurance resources. As a result, you can better anticipate processing timelines.

Frequently Asked Questions

Why do some claims take longer than others?

Complex services often require additional documentation and coverage review.

Can patients check claim status online?

Yes. Most insurers provide portals that show real-time claim updates.

Does out-of-network care delay claims?

Yes. Out-of-network claims usually require manual review and documentation.

Contact Vivna Insurance for Help

If you have questions about claim timelines or coverage details, Vivna Insurance can help. Our licensed agents explain benefits clearly so you can avoid surprises.

Call 888-730-6001 or explore our Health Insurance Blog.

For trusted health information, visit the National Institutes of Health and the Centers for Disease Control and Prevention.