Health Insurance Claim Status | What Happens After Filing

Understanding Health Insurance Claim Status

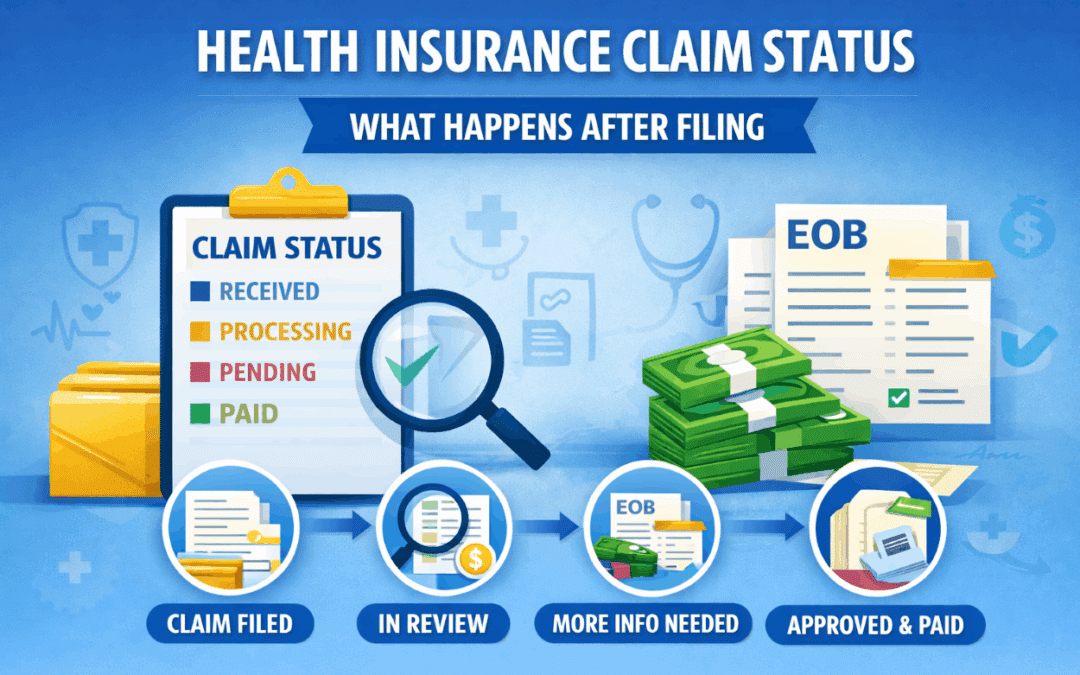

Health Insurance Claim Status tells you where a claim stands after you receive care and your provider requests payment from your insurer. Although most claims move forward automatically, it still helps to understand what each status means. As a result, you can follow up faster, reduce delays, and avoid billing surprises.

In many cases, your provider submits the claim and your insurance company reviews it. Meanwhile, you may see updates through your member portal and on your Explanation of Benefits. Therefore, when you understand Health Insurance Claim Status, you gain clearer control over timing, payments, and next steps.

What Happens Right After a Claim Is Submitted

First, your insurer receives the claim and assigns a tracking number. Next, the system checks basic details such as coverage dates and provider billing information. Additionally, it verifies that the services match valid billing codes. If information is missing, the insurer pauses the claim and requests a correction.

Because claims include many data points, even small errors can create delays. However, most issues are easy to fix once you identify the missing detail and respond quickly. As a result, a short phone call to the provider’s billing office often solves the problem.

Common Claim Status Updates and What They Mean

Insurance companies use similar status labels, even if the wording varies. For example, you might see “received,” “in process,” “pending,” or “paid.” In general, these updates fall into a few predictable categories. Consequently, you can usually tell what to do by matching the status to the stage of review.

Claim Received

“Claim received” means your insurer has the claim in its system, but the review has not finished. Usually, you do not need to do anything yet. However, if the claim stays in this status for too long, you should contact your provider to confirm they submitted it correctly.

In Review or Processing

When Health Insurance Claim Status shows “processing,” your insurer is actively evaluating the claim. First, they confirm that your plan was active on the service date. Next, they check coverage rules for the service. Then they apply plan cost-sharing so they can calculate the payment.

If you want help understanding how your benefits apply, you can review plan guidance through Vivna health insurance resources. Additionally, learning how your plan works makes it easier to predict your share before the bill arrives.

Pending Information

A “pending” status usually means the insurer needs more details to finalize payment. For instance, they may request a corrected code, a referral note, or additional documentation. Meanwhile, your provider may need to resubmit information. Therefore, it often helps to call the provider’s billing team and ask what the insurer requested.

Additionally, you can call the insurer and ask which document is missing. As a result, you can coordinate both sides and move the claim forward faster.

Denied

A denied claim means the insurer did not approve payment under the current submission. However, denial does not always mean you must pay the full amount. Instead, a denial often means something needs correction, clarification, or a different billing code.

For example, denials can happen due to missing pre-authorization, out-of-network rules, or documentation issues. Therefore, you should review the Explanation of Benefits and confirm why the insurer denied the claim. Then, you can decide whether the provider should correct and resubmit or whether you should appeal.

Approved and Paid

When Health Insurance Claim Status shows “paid,” your insurer has completed the review and sent payment. Typically, the insurer pays the provider directly for covered services. Meanwhile, any remaining amount becomes your responsibility based on your plan’s cost-sharing rules.

Because cost-sharing varies, two people can receive the same service and still owe different amounts. As a result, it helps to compare your Explanation of Benefits against the provider bill before you pay.

How to Read Your Explanation of Benefits

Your Explanation of Benefits, often called an EOB, summarizes how the insurer processed the claim. Importantly, the EOB is not a bill. Instead, it explains what the provider charged, what the insurer allowed, what the insurer paid, and what you may owe.

When you review an EOB, focus on these key items:

- The service date and provider name

- The amount billed and the allowed amount

- The insurer payment amount

- Your responsibility, such as deductible, copay, or coinsurance

- Any adjustment notes, remarks, or denial codes

Additionally, watch for mismatches between the EOB and the provider bill. If the provider bill does not match, contact the billing office before paying. As a result, you can avoid paying charges that should have been adjusted or written off.

Why Claim Status Can Change More Than Once

Health Insurance Claim Status can change multiple times because claims often move through checks in stages. First, the insurer confirms eligibility. Next, they verify coverage rules. Then they apply cost-sharing and finalize payment. Consequently, you might see a claim switch from “received” to “processing” and then to “paid.”

Sometimes, a claim can also reopen. For example, a provider may submit a correction, or the insurer may request additional records. However, these changes are normal, and they do not automatically mean a problem exists. Instead, they often mean the insurer is finalizing details.

How to Speed Up a Stuck Claim

If your claim stays “pending” or “processing” longer than expected, you can take practical steps. First, contact the provider’s billing department and confirm they submitted the correct codes and documentation. Next, call the insurer and ask exactly what they need. Additionally, request the fax number or portal instructions so the provider can deliver documents quickly.

Moreover, keep notes of names, dates, and reference numbers. As a result, follow-ups become easier, and you reduce the risk of repeating the same conversation.

When You Should Consider an Appeal

If Health Insurance Claim Status shows “denied,” you should confirm whether a correction can solve it. Often, providers can resubmit a corrected claim. However, if the insurer denies payment due to a coverage decision, an appeal may be appropriate.

In that situation, review the denial reason, gather supporting documents, and follow the insurer’s appeal steps. Additionally, keep a copy of everything you submit. Therefore, you maintain a clear record if you need to escalate the issue later.

Frequently Asked Questions

How long does Health Insurance Claim Status stay “processing”?

Many claims process within a few weeks, although complex claims can take longer. However, delays often improve once missing information is provided.

Can I check claim status without calling?

Yes. Many insurers provide a member portal that shows Health Insurance Claim Status updates. Additionally, your EOB provides detailed results once the claim finishes.

What should I do if the provider bills me before the claim is paid?

First, compare the bill to your claim status. Next, contact the provider and ask them to wait for the claim to complete. As a result, you can avoid paying the wrong amount.

Does a denied claim always mean I must pay?

No. A denial can happen due to coding or documentation issues. Therefore, a corrected resubmission or appeal may still resolve the payment.

Contact Vivna Insurance for Help

If you want help understanding Health Insurance Claim Status and how your benefits apply, Vivna Insurance can guide you. Our licensed agents explain coverage details clearly so you can make confident decisions and reduce claim confusion.

Call 888-730-6001 for help or explore more educational guides in our Health Insurance Blog. Additionally, you can review plan guidance through our Health Insurance page.

For trusted health information, visit the National Institutes of Health and the Centers for Disease Control and Prevention.