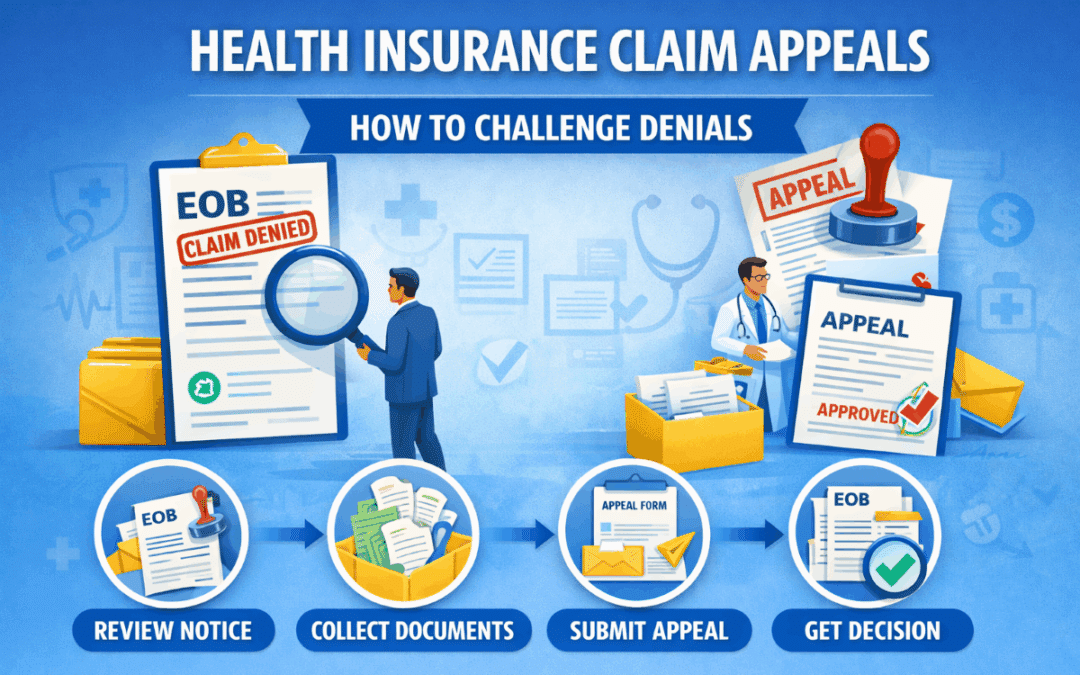

Health Insurance Claim Appeals | How to Challenge Denials

Understanding Health Insurance Claim Appeals

Health Insurance Claim Appeals allow you to request a second review after an insurer denies payment for a medical service. Although a denial can feel stressful, an appeal gives you a formal opportunity to provide additional documentation and explain why the claim should be covered. As a result, many denied claims are successfully reversed after review.

Insurance companies deny claims for various reasons, including coding errors, missing information, or coverage misunderstandings. Therefore, understanding how the appeal process works helps you respond quickly and improve your chances of approval.

Common Reasons You May Need to File an Appeal

Health Insurance Claim Appeals typically occur when a denial relates to coverage decisions rather than simple billing mistakes. In many situations, providers can correct coding errors without a formal appeal. However, when an insurer questions medical necessity or policy rules, an appeal becomes necessary.

For example, insurers may deny claims due to lack of prior authorization, out-of-network treatment rules, or insufficient documentation. Consequently, reviewing the denial explanation carefully helps determine the correct next step.

Step 1: Review the Explanation of Benefits

The first step in Health Insurance Claim Appeals involves reviewing your Explanation of Benefits. This document explains why the insurer denied the claim and provides a denial code. Additionally, it includes instructions describing how to request a review.

If you need help understanding your coverage rules, you can review plan guidance through Vivna health insurance resources. As a result, you can determine whether the denial relates to policy limits or missing documentation.

Step 2: Gather Supporting Documentation

After identifying the denial reason, collect documents that support your appeal. These may include medical records, referral letters, provider notes, or prior authorization approvals. Additionally, ask your provider to submit a statement explaining why the treatment was medically necessary.

Because strong documentation directly influences appeal decisions, providing detailed evidence significantly increases approval chances.

Step 3: Submit the Appeal Request

Once documentation is ready, submit your appeal using the insurer’s required method. Most insurers allow online submissions, mailed forms, or fax requests. Therefore, following the exact instructions ensures the insurer processes your appeal without delay.

Additionally, keep copies of all documents and confirmation numbers. As a result, you can track progress and respond quickly if the insurer requests additional information.

Step 4: Track Appeal Status

After submission, insurers review appeals within a defined timeframe. Typically, standard appeals take several weeks, although urgent medical appeals may receive faster review. Consequently, checking your member portal regularly helps you stay informed.

If you do not receive updates, contact the insurer directly to confirm they received your documents.

What Happens If an Appeal Is Denied

If Health Insurance Claim Appeals remain denied after review, you may have additional options. Many plans allow a second-level appeal or an external review by an independent organization. Therefore, carefully reading the final denial notice helps you understand your remaining rights.

External reviews often provide an impartial evaluation, which can result in claim approval even after multiple denials.

How to Prevent Future Claim Appeals

You can reduce the need for Health Insurance Claim Appeals by taking preventive steps. First, confirm whether services require prior authorization. Next, verify that providers are within your network. Additionally, keep copies of referrals and approval letters.

Because proactive planning prevents coverage misunderstandings, these steps reduce the likelihood of future denials.

Frequently Asked Questions

How long do claim appeals take?

Most appeals are reviewed within several weeks, although urgent appeals may receive faster decisions.

Do providers help with appeals?

Yes. Providers often supply documentation and medical necessity letters to support appeals.

Can an appeal guarantee approval?

No. However, strong documentation significantly increases the likelihood of approval.

Contact Vivna Insurance for Help

If you need guidance with Health Insurance Claim Appeals, Vivna Insurance can help you understand your coverage and next steps. Our licensed agents explain plan details clearly so you can avoid costly surprises.

Call 888-730-6001 or explore resources in our Health Insurance Blog.

For trusted health information, visit the National Institutes of Health and the Centers for Disease Control and Prevention.