Health Insurance Cost Breakdown Guide

Health insurance cost breakdown guide content helps individuals understand how medical expenses are structured before care is needed.

Rather than focusing only on monthly premiums, health insurance costs include several moving parts that work together.

As a result, understanding the full cost breakdown allows people to plan more accurately and avoid financial surprises.

Although health insurance pricing can appear confusing at first, each cost component serves a specific purpose.

Therefore, once these elements are explained clearly, comparing plans becomes much easier.

In addition, understanding cost structure supports smarter enrollment and budgeting decisions.

Why Understanding Health Insurance Costs Matters

Health insurance costs affect both short-term budgeting and long-term financial stability.

Rather than paying a single flat price, most plans divide costs across multiple categories.

As a result, the true cost of coverage is not always obvious at first glance.

Many people choose plans based on monthly affordability alone.

However, focusing only on premiums can lead to higher overall spending when care is needed.

Therefore, understanding how different cost elements interact is essential for accurate planning.

According to the

National Institutes of Health,

unexpected medical expenses are a leading source of financial stress.

Consequently, understanding health insurance cost structure helps reduce that risk.

Premiums and What They Represent

The premium is the amount paid regularly to maintain active health insurance coverage.

Typically, premiums are billed monthly regardless of whether medical care is used.

As a result, premiums represent the baseline cost of having coverage in place.

Lower premiums often attract attention because they reduce monthly expenses.

However, plans with lower premiums frequently include higher cost sharing.

Therefore, premium affordability should always be evaluated alongside other cost elements.

Premiums also reflect plan design, network access, and benefit scope.

As a result, differences in pricing often correspond to differences in coverage depth.

Consequently, understanding premium context prevents misinterpretation.

Deductibles and Their Financial Impact

A deductible is the amount a policyholder must pay for covered services before the plan begins contributing.

Until the deductible is met, most medical expenses are paid out of pocket.

As a result, deductibles represent a major upfront cost consideration.

Plans with higher deductibles often feature lower premiums.

While this tradeoff may work for individuals with minimal healthcare use, it increases risk when care is needed.

Therefore, deductible size should align with expected medical usage.

Understanding deductibles is especially important for individuals with chronic conditions.

Because regular care can accumulate quickly, deductible exposure matters.

As a result, evaluating this cost element helps prevent budget strain.

Copayments Explained Clearly

Copayments are fixed amounts paid for specific services, such as doctor visits or prescriptions.

Unlike deductibles, copays apply at the time care is received.

As a result, copays create predictable per-visit costs.

Copays vary depending on service type.

For example, primary care visits often have lower copays than specialist visits.

Therefore, understanding copay structure helps estimate routine healthcare expenses.

Although copays are typically smaller than full service costs, they add up over time.

As a result, frequent visits can significantly impact total annual spending.

Consequently, copay levels deserve close attention during plan comparison.

Coinsurance and Shared Cost Responsibility

Coinsurance represents a percentage of medical costs shared between the insurer and the policyholder.

After the deductible is met, coinsurance often replaces copayments.

As a result, the cost responsibility becomes variable rather than fixed.

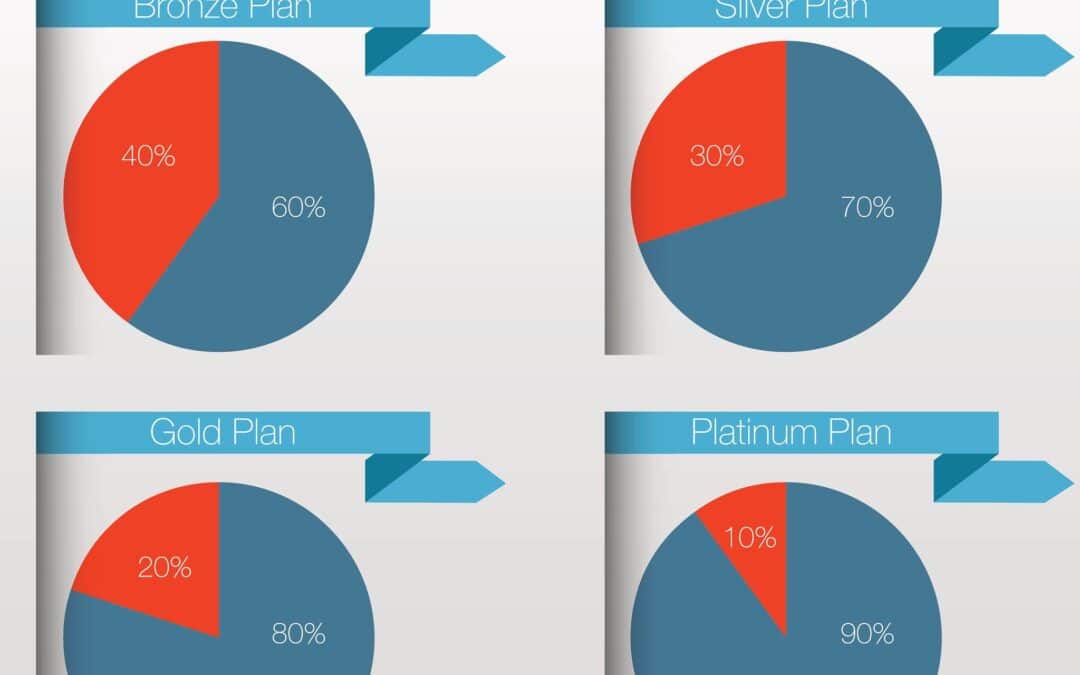

For example, a plan may require the member to pay a portion of the cost while the insurer pays the remainder.

Because service costs vary, coinsurance amounts can fluctuate significantly.

Therefore, understanding coinsurance rates is essential for cost forecasting.

Coinsurance plays a larger role in hospital care and specialized services.

As a result, individuals expecting major procedures should pay particular attention to this element.

Consequently, coinsurance planning supports financial preparedness.

Out-of-Pocket Maximums and Cost Protection

The out-of-pocket maximum is the highest amount a policyholder must pay for covered services during a coverage period.

Once this limit is reached, the plan covers eligible expenses in full.

As a result, this feature provides financial protection during serious health events.

Out-of-pocket maximums include deductibles, copays, and coinsurance.

However, premiums are not counted toward this limit.

Therefore, understanding what qualifies is important.

Plans with lower out-of-pocket maximums often provide stronger financial safeguards.

As a result, individuals with higher medical risk may prioritize this feature.

Consequently, this cost cap plays a central role in overall plan value.

Network Costs and Provider Pricing

Provider networks influence how much care ultimately costs.

In-network providers have negotiated rates with insurers, resulting in lower costs.

As a result, staying in network usually reduces out-of-pocket expenses.

Out-of-network care often costs more and may not be fully covered.

Because pricing is not standardized, bills can increase significantly.

Therefore, reviewing network access is a critical cost consideration.

According to the

Centers for Disease Control and Prevention,

access to preventive care improves health outcomes.

Consequently, network availability affects both cost and care quality.

Prescription Drug Costs

Prescription coverage adds another layer to health insurance cost structure.

Medications are typically grouped into tiers, each with different pricing.

As a result, drug costs vary depending on classification.

Lower-tier medications usually carry lower copays or coinsurance.

Higher-tier or specialty drugs often involve higher cost sharing.

Therefore, reviewing medication coverage is essential for accurate budgeting.

For individuals taking ongoing prescriptions, medication costs can exceed other medical expenses.

As a result, evaluating formularies helps prevent unexpected pharmacy costs.

Consequently, prescription review is a necessary step in plan selection.

How Supplemental Coverage Can Offset Costs

Supplemental coverage can help manage gaps created by deductibles, copays, and coinsurance.

Rather than replacing medical insurance, these plans add financial support.

As a result, out-of-pocket exposure may be reduced.

Individuals exploring

supplemental coverage options

often aim to stabilize healthcare spending.

Therefore, combining coverage types can improve predictability.

Supplemental benefits are especially useful for high-deductible plans.

As a result, layered protection supports stronger financial planning.

Balancing Monthly and Annual Costs

Choosing a health insurance plan involves balancing monthly affordability with annual risk.

Lower premiums reduce monthly strain but increase cost exposure.

As a result, tradeoffs must be evaluated carefully.

Higher premiums may reduce out-of-pocket spending when care is used.

Therefore, individuals expecting frequent care may benefit from this structure.

In addition, stable healthcare needs often favor predictable costs.

Understanding total annual cost potential helps avoid regret after enrollment.

Consequently, this holistic view supports smarter decisions.

Common Cost Comparison Mistakes

One common mistake is comparing plans using premiums alone.

Although premiums are visible, they do not represent total cost.

As a result, incomplete comparison leads to inaccurate conclusions.

Another mistake is ignoring provider networks and medication coverage.

Because these factors drive real-world costs, overlooking them increases risk.

Therefore, comprehensive comparison is essential.

Finally, many people underestimate how often they use healthcare services.

As a result, plans may not match actual usage patterns.

Consequently, realistic self-assessment improves outcomes.

Why This Health Insurance Cost Breakdown Guide Matters

Health insurance cost breakdown guide content empowers consumers to make informed decisions.

Rather than guessing at costs, individuals gain clarity.

As a result, financial stress is reduced.

In addition, understanding cost structure improves enrollment confidence.

Because decisions are grounded in knowledge, coverage aligns with needs.

Therefore, education becomes a powerful planning tool.

Ultimately, understanding health insurance costs supports better healthcare access and financial stability.

When cost expectations are clear, individuals are better prepared.

Frequently Asked Questions

What costs make up health insurance?

Health insurance costs include premiums, deductibles, copays, coinsurance, and out-of-pocket maximums.

Which cost matters most?

The most important cost depends on how often care is used and the type of services needed.

Can supplemental coverage reduce costs?

Supplemental coverage may help offset deductibles and other out-of-pocket expenses.

How can I estimate annual costs?

Review expected care usage, prescriptions, and cost-sharing structure together to estimate total spending.

Contact Us Now

This health insurance cost breakdown guide helps you understand how medical expenses really work.

If you want help comparing plans or evaluating costs, speak with a licensed agent today.

Call

888-730-6001

or explore additional resources in our

Health Insurance Blog.

For additional educational resources, visit the

NIH

and the

CDC.