Short Term Health Insurance

Short Term Health Insurance provides temporary medical coverage for individuals and families experiencing coverage gaps due to job changes, waiting periods, or unexpected life transitions. These plans are designed to offer fast enrollment and flexible options when traditional coverage is not immediately available. Through Vivna Insurance, you can compare short-term plans from trusted carriers like UnitedHealthcare and Pivot Health, helping you find coverage that fits your short-term needs and budget. While short-term health insurance is not ACA-compliant, it can help with doctor visits, emergency care, and hospital services during temporary coverage periods. For personalized guidance, speak with a licensed Vivna Insurance agent at 888-730-6001.

Understand Short-Term Health Insurance.

Fast Coverage Start

Fast Coverage Start

Short term health insurance is a practical option for individuals who need medical coverage to begin quickly. These plans are designed for faster enrollment than many traditional options, making them useful during sudden life changes or unexpected coverage gaps.

Bridges Temporary Coverage Gaps

Bridges Temporary Coverage Gaps

Short term health insurance works well for people who need temporary medical coverage while transitioning between plans. This can include waiting for employer coverage to start or moving between longer-term insurance options.

Flexible Plan Options

Flexible Plan Options

Short term plans offer flexibility in coverage levels, deductibles, and provider access. Vivna Insurance helps compare short-term options from trusted carriers like UnitedHealthcare and Pivot Health to help find a plan that fits short-term needs and budgets.

Access to Essential Medical Care

Access to Essential Medical Care

While short term health insurance is not ACA-compliant, it can help cover essential medical services such as doctor visits, emergency care, and hospital treatment during temporary coverage periods.

Why Short Term Health Insurance May Be a Good Fit

Understanding Short Term Health Insurance helps individuals make informed decisions when permanent medical coverage is not immediately available. Short term health insurance is designed to provide temporary medical benefits during coverage gaps, such as employment changes or waiting periods for other plans to begin. These plans typically focus on essential services like doctor visits, emergency care, and hospital treatment, while offering faster enrollment than many traditional options. Coverage terms and benefits can vary by carrier, which is why Vivna Insurance helps you compare short-term options from providers such as UnitedHealthcare and Pivot Health. While short term health insurance is not ACA-compliant, it can serve as a practical solution for temporary medical needs when long-term coverage is not yet in place.

Frequently Asked Questions

What is short term health insurance?

Short term health insurance is a type of temporary medical coverage designed to help individuals and families during coverage gaps. These plans can help cover certain medical services such as doctor visits, emergency care, and hospital treatment for a limited period of time.

Who should consider short term health insurance?

Short term health insurance may be a good option for people who are between jobs, waiting for other coverage to begin, or experiencing a temporary life transition. It is often used when long-term or employer-based coverage is not immediately available.

Is short term health insurance ACA-compliant?

No, short term health insurance plans are not ACA-compliant. This means they do not include all the benefits required under the Affordable Care Act and may have limitations or exclusions compared to ACA Marketplace plans.

What does short term health insurance typically cover?

Coverage can vary by plan and carrier, but short term health insurance often helps with medical services such as doctor visits, emergency care, and hospital stays. Benefits, coverage limits, and exclusions depend on the specific plan selected.

Contact Vivna Insurance

888-730-6001

To complete the form below to request your personalized insurance review.

Get a Free Quote

For additional information about dental and vision care, you can explore trusted health resources such as the

National Institutes of Health (NIH) and the Centers for Disease Control and Prevention (CDC).

Vivna Insurance helps individuals and families compare coverage options, including Supplemental Insurance,

to support a well-rounded insurance strategy. To explore all coverage options and resources, visit the Vivna Insurance home page

or browse the latest guides in the Vivna Insurance Blog.

Health & Insurance Blog Insights

How Health Insurance Costs Change After Major Life Events

Health insurance cost changes often happen after major life events such as marriage, job changes, or relocation.

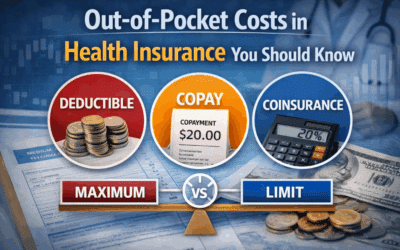

Out-of-Pocket Costs in Health Insurance You Should Know

Out-of-pocket health insurance costs include deductibles, copays, coinsurance, and maximum limits that affect total spending.

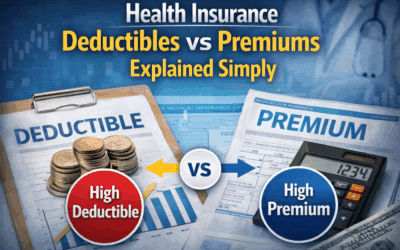

Health Insurance Deductibles vs Premiums Explained Simply

Health insurance deductibles premiums affect both monthly costs and out-of-pocket expenses when care is needed.

What Affects Your Monthly Health Insurance Premium

Several factors affect your monthly health insurance premium, including coverage design, networks, benefits, and location.

Why Health Insurance Costs Vary So Much | Vivna Insurance

Health insurance costs vary so much due to coverage levels, deductibles, networks, and regional pricing differences.

How Health Insurance Billing Works

Learn how health insurance billing works, including claims, EOBs, and patient responsibility after care.

In-Network vs Out-of-Network Costs

Learn the difference between in-network and out-of-network costs and how provider networks affect your healthcare expenses.

What Is an Out-of-Pocket Maximum

Learn what an out-of-pocket maximum is and how it protects you from high medical costs when using health insurance.

How Health Insurance Works

Learn how health insurance works, including premiums, deductibles, provider networks, and cost sharing so you can choose coverage confidently.

What Health Insurance Covers Understanding Benefits & Coverage

What Health Insurance Covers includes preventive care, doctor visits, hospital services, and prescriptions. Learn what’s included and where gaps may exist.