Welcome to Vivna Insurance of Georgia

Choosing the right Georgia health insurance can feel complicated until your options are clearly explained and compared. Vivna Insurance helps Georgia residents explore ACA Marketplace coverage, private medical plan options, short-term and tri-term coverage, dental & vision plans, supplemental benefits, and life insurance so your coverage strategy feels simple, flexible, and well-organized from the start.

To begin, many Georgia residents review plan education and coverage basics on our Health Insurance page. You can also explore carrier resources and plan information through UnitedHealthcare, then strengthen your protection strategy with Dental & Vision Insurance, Supplemental Insurance, and Life Insurance.

For personal assistance with Georgia health insurance, call 888-730-6001.

VIVNA ONLY WORKS WITH

CARRIERS YOU CAN TRUST

Your Options for Georgia Health Insurance

Georgia health insurance includes ACA Marketplace coverage, private major medical plans, short-term and tri-term options, supplemental policies, dental & vision plans, and life insurance. Because every Georgia household has unique doctor preferences, prescription needs, and financial situations, Vivna Insurance helps organize your choices so your next steps feel clear, informed, and manageable.

Georgia ACA Marketplace Plans

Georgia Marketplace plans include essential health benefits such as preventive care, emergency services, maternity support, mental health care, and prescription drug coverage. Many residents qualify for income-based savings that can reduce monthly premiums. Vivna Insurance helps you compare plan levels, understand provider networks, and estimate total costs so you can choose coverage with confidence.

Private Georgia Health Insurance Plans

Private plans may appeal to Georgia residents who prefer different network designs or benefit structures. Depending on plan type, you may see different deductibles, copays, and prescription coverage approaches. To learn more about plan basics and comparison steps, visit our Health Insurance page. If you want help reviewing options, you can reach us through Contact Us.

Short-Term and Tri-Term Coverage for Georgia Residents

Short-term coverage can help Georgia residents who need temporary insurance during employment transitions, waiting periods, or enrollment gaps. In addition, tri-term coverage may offer longer flexibility for people who want a temporary alternative outside of ACA Marketplace plans. Because these options do not always include the same protections as ACA coverage and may involve medical underwriting, it is important to review limitations, eligibility, and exclusions carefully.

UnitedHealthcare Options in Georgia

UnitedHealthcare options may include network-based plan designs and additional member tools that many families value. To explore carrier information and coverage education, visit our UnitedHealthcare page.

Georgia Supplemental Insurance Plans

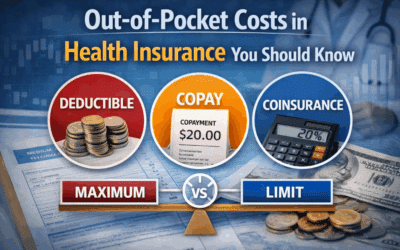

Supplemental coverage can provide extra financial support when certain illnesses or injuries occur. For example, some plans are designed to help with costs related to hospital stays, accidents, or critical illness events. Since these policies can add an extra layer of protection, many Georgia residents use them to help manage deductibles, coinsurance, and other out-of-pocket expenses. Learn more on our Supplemental Insurance page.

Dental & Vision Insurance in Georgia

Dental and vision coverage can reduce your costs for routine exams, cleanings, imaging, frames, and contacts. As a result, many Georgia residents pair these options with medical coverage to support everyday wellness. Explore options on our Dental & Vision Insurance page.

Georgia Life Insurance Options

Life insurance helps protect your family’s financial stability. Georgia residents may explore term and permanent life policies to support income replacement, debts, and long-term planning. Learn more on our Life Insurance page.

Education and Support from Vivna Insurance

Vivna provides ongoing education to help you understand coverage terms, plan features, and cost strategies. You can explore helpful topics on our Health Insurance Blog and learn more about our services at Vivna Insurance.

Get Personalized Help with Georgia Health Insurance

Vivna Insurance helps Georgia residents compare ACA Marketplace coverage, private plan options, supplemental benefits, dental & vision coverage, short-term and tri-term plans, and life insurance. For personal guidance, call 888-730-6001 or reach out through Contact Us.

FAQ — Georgia Health Insurance

How can I compare Georgia health insurance plans?

Start by reviewing your doctors, prescriptions, and household budget. Then compare plan types, benefit structures, and coverage levels using our Health Insurance resources. Vivna Insurance helps explain how different options work so you can make informed decisions.

Is Marketplace coverage my only Georgia health insurance option?

No. Georgia residents may also consider private medical plans, short-term and tri-term coverage, supplemental insurance, dental and vision plans, and life insurance. Vivna Insurance helps compare these options based on coverage goals, budget, and eligibility.

Are dental & vision plans available in Georgia?

Yes. Dental and vision coverage is available in Georgia and can help manage routine care costs such as exams, cleanings, imaging, glasses, and lenses. Learn more on our Dental & Vision Insurance page.

Is short-term coverage offered in Georgia?

Yes. Short-term and tri-term health insurance plans are available in Georgia and may be used during temporary coverage gaps. These plans typically do not include all essential health benefits and may involve medical underwriting, so reviewing limitations carefully is important.

How does Vivna help Georgia residents choose coverage?

Vivna Insurance helps Georgia residents compare ACA Marketplace coverage, private plans, supplemental insurance, dental and vision options, short-term and tri-term coverage, and life insurance. For personal guidance, call 888-730-6001 or reach out through our Contact Us page.

Contact Vivna Insurance

888-730-6001

To complete the form below to request your personalized insurance review.

Get a Free Quote

For additional information about dental and vision care, you can explore trusted health resources such as the

National Institutes of Health (NIH) and the Centers for Disease Control and Prevention (CDC).

Vivna Insurance helps individuals and families compare coverage options, including Supplemental Insurance,

to support a well-rounded insurance strategy. To explore all coverage options and resources, visit the Vivna Insurance home page

or browse the latest guides in the Vivna Insurance Blog.

Health & Insurance Blog Insights

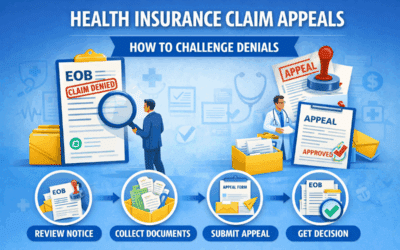

Health Insurance Claim Appeals | How to Challenge Denials

Learn how Health Insurance Claim Appeals work so you can challenge denied claims, provide documentation, and improve approval chances.

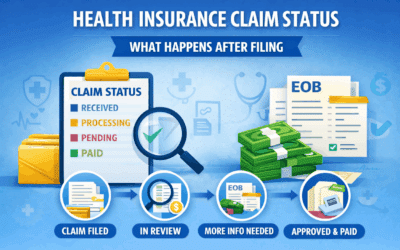

Health Insurance Claim Status | What Happens After Filing

Learn what Health Insurance Claim Status updates mean after filing and how to move a pending claim forward faster.

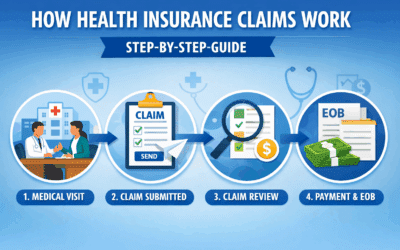

Health Insurance Claims Process | Step-By-Step Guide

Understand the Health Insurance Claims Process step by step so you can manage medical bills and avoid payment surprises.

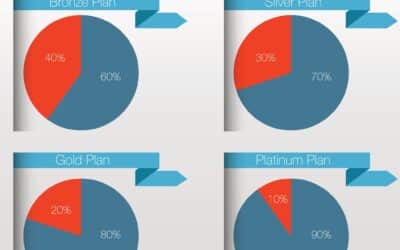

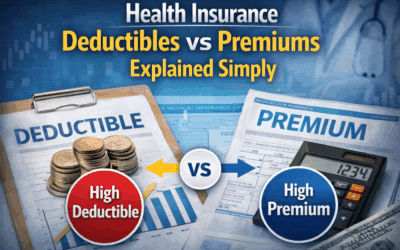

Health Insurance Cost Breakdown Guide

A detailed guide explaining health insurance costs, including premiums, deductibles, copays, coinsurance, and out-of-pocket maximums.

How Health Insurance Costs Change After Major Life Events

Health insurance cost changes often happen after major life events such as marriage, job changes, or relocation.

Out-of-Pocket Costs in Health Insurance You Should Know

Out-of-pocket health insurance costs include deductibles, copays, coinsurance, and maximum limits that affect total spending.

Health Insurance Deductibles vs Premiums Explained Simply

Health insurance deductibles premiums affect both monthly costs and out-of-pocket expenses when care is needed.

What Affects Your Monthly Health Insurance Premium

Several factors affect your monthly health insurance premium, including coverage design, networks, benefits, and location.

Why Health Insurance Costs Vary So Much | Vivna Insurance

Health insurance costs vary so much due to coverage levels, deductibles, networks, and regional pricing differences.

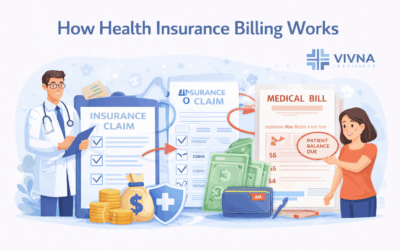

How Health Insurance Billing Works

Learn how health insurance billing works, including claims, EOBs, and patient responsibility after care.