WELCOME TO VIVNA INSURANCE

Where Life & Healthcare Cross Paths

Vivna Insurance helps individuals, families, and small businesses secure affordable health, life, supplemental, and dental and vision coverage. In addition, our licensed agents take time to review your needs, compare available options, and clearly explain coverage choices so you can make informed decisions with confidence.

Vivna Works With Only The Best Carriers,

So That We Can Provide You With The Best Coverage

Vivna Has Every Type of Plan For Every Type of Person.

You’re in The Right Place to Find What You Need.

Additional Insurance Options

Health Insurance

Choose affordable health insurance crafted to fit your doctors, prescriptions, and budget. Compare ACA Marketplace plans, short-term medical options, and trusted insurance solutions that help you stay protected year-round.

Life Insurance

Protect your family’s long-term financial future with personalized

life insurance options, including term and whole life coverage. Get clear guidance so you feel confident choosing the right policy for your needs.

Supplemental Insurance

Enhance your protection with Supplemental Insurance. This helps manage deductibles, copays, hospital stays, accident costs, and unexpected medical bills.

Dental & Vision Coverage

Keep your smile and eyesight protected with flexible. Dental and vision insurance options cover exams, cleanings, glasses, fillings, and preventive care for long-term wellness.

Vivna Provides Affordable Health Insurance Nationwide.

Alabama

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

Nevada

New Hamp.

New Jersey

New Mexico

New York

North Carolina

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

South Dakota

Tennessee

Frequently Asked Questions From Our Clients

What types of insurance does Vivna offer?

Vivna offers Health Insurance, Dental & Vision coverage, Life Insurance, and Supplemental Insurance. Our advisors compare multiple plan options and guide you toward coverage that fits your needs and budget.

How do Vivna agents help me choose the right plan?

Our licensed agents review your doctors, prescriptions, goals, and budget. Then we compare multiple carriers and explain each option clearly, so you can choose the right plan with confidence.

Does Vivna work with multiple insurance companies?

Yes. Vivna partners with trusted carriers such as UnitedHealthcare, Pivot Health, Oscar, Aflac, OneShare Health, and UBA. Working with multiple companies allows us to offer more plan choices.

Is there a cost to work with a Vivna Insurance agent?

No. Our services are completely free. You pay the same price whether you enroll on your own or receive expert help from a licensed Vivna agent.

Can Vivna help me understand my ACA Marketplace options?

Absolutely. We review subsidy eligibility, compare ACA Marketplace plans, explain out-of-pocket costs, and guide you through each step of the enrollment process from start to finish.

What is a short term medical plan?

Short-term plans can help you get the benefits you need in times when you may have a coverage gap — like when you’re in between jobs or waiting for other coverage to start.

What are the durations of a Short Term medical plan.

UnitedHealthcare offers Short-Term medical plans ranging from 3 to 12 months.

What is an ACA Marketplace Plan?

ACA plans are sold on the health care Marketplace (also known as Obama Care). Depending on your income, you may be eligible for government subsidies to help lower the cost of an ACA plan.

Am I required to have Health Insurance?

No, you are not. There are specific States that have their own individual mandates, with possible TAX PENALTIES if you don’t have coverage. California, Massachusetts, New Jersey, Rhode Island, Vermont, and Washington, DC. It is always best to have Health Insurance.

Are there any plans that I don't have to renew every year?

Yes, many carriers, such as United Healthcare and Pivot Health, offer a Tri-Term plan. A TriTerm plan has a duration of 36 months.

Why Choose Vivna Insurance

Personalized Support

Our team takes the time to understand your doctors, budget, and coverage goals so we can recommend the plans that work best for you.

Nationwide Coverage

Whether you’re looking for local options or nationwide plans, Vivna helps you explore a wide range of insurance choices in your state.

Choose Your Carrier

We work with trusted carriers including UnitedHealthcare, Pivot Health, Oscar, Aflac, and others to provide competitive plan options.

Clear, Simple Guidance

We walk you through every step—from comparing plans to selecting coverage—so you always feel confident in your choice.

Testimonials From Our Clients

Treena M.

– Treena M.

Shanyn W-K.

Thank you both,

Shanyn Warren-Kimsey

Lisa P.

Nov 30, 2023

Renewal period and put off dealing with making this call because I dreaded it! But …I was blessed to get Heather to help me, and she was AMAZING! Called when she said she would and took 100% care of every step, including calling my doctors to ensure they were in the plans we were shopping. Thank you, Heather, for making an awful chore tolerable and, dare I say, enjoyable.

– Lisa P.

Jane U.

I just signed up, and my coverage hasn’t begun yet, so I can’t vouch for the company or the plan, but Jessica was very helpful and positive, and professional. She answered all my questions and walked me through every step of the application process. Excellent agent!

Alicia S.

Dec 4, 2020

Heather S. is FANTASTIC, and her customer service was remarkable! She walked me through the entire process and made me feel like family. Throughout my experience, she showed kindness and professionalism, responsiveness and genuine care – ensuring I was taken care of each step of the way. Great service and people! A+

– Alicia S.

Ieva W.

Jessica was a helpful agent, and I am so excited to have my insurance get going with her positive attitude!

Kimberly S.

Dec 7, 2022

Heather Sprague is bar none the best health insurance rep I’ve ever had. She personally calls you even on off-hours if you have a question, and she fixes any issues you might have. I can’t say enough good things about her and vivna – honest, trustworthy, reliable, and just good people who care!

– Kimberly S.

Nick G.

Health & Insurance Blog

How Health Insurance Costs Change After Major Life Events

Health insurance cost changes often happen after major life events such as marriage, job changes, or relocation.

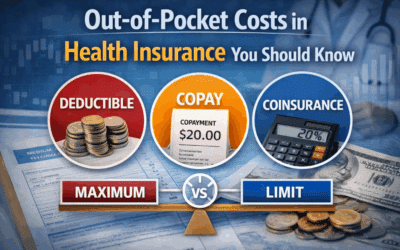

Out-of-Pocket Costs in Health Insurance You Should Know

Out-of-pocket health insurance costs include deductibles, copays, coinsurance, and maximum limits that affect total spending.

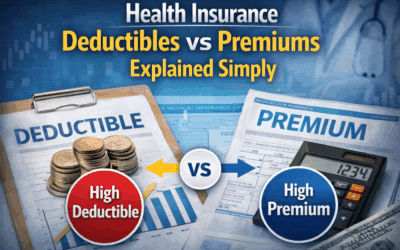

Health Insurance Deductibles vs Premiums Explained Simply

Health insurance deductibles premiums affect both monthly costs and out-of-pocket expenses when care is needed.

What Affects Your Monthly Health Insurance Premium

Several factors affect your monthly health insurance premium, including coverage design, networks, benefits, and location.

Why Health Insurance Costs Vary So Much | Vivna Insurance

Health insurance costs vary so much due to coverage levels, deductibles, networks, and regional pricing differences.

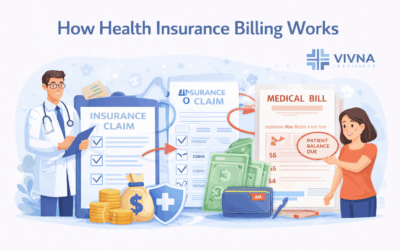

How Health Insurance Billing Works

Learn how health insurance billing works, including claims, EOBs, and patient responsibility after care.

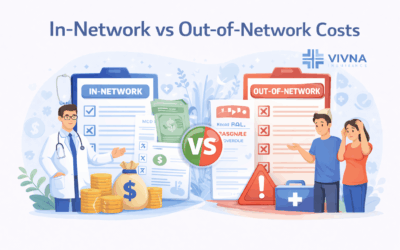

In-Network vs Out-of-Network Costs

Learn the difference between in-network and out-of-network costs and how provider networks affect your healthcare expenses.

What Is an Out-of-Pocket Maximum

Learn what an out-of-pocket maximum is and how it protects you from high medical costs when using health insurance.

How Health Insurance Works

Learn how health insurance works, including premiums, deductibles, provider networks, and cost sharing so you can choose coverage confidently.

What Health Insurance Covers Understanding Benefits & Coverage

What Health Insurance Covers includes preventive care, doctor visits, hospital services, and prescriptions. Learn what’s included and where gaps may exist.

Choosing Health Insurance Coverage | A Simple Plan Comparison Guide

Choosing Health Insurance Coverage doesn’t have to be stressful. Learn how to compare premiums, deductibles, networks, and benefits with a clear checklist.

Healthcare Expenses in Early Retirement: What to Expect and How to Save

Healthcare costs can surprise early retirees. Learn how to plan ahead, build savings, and explore insurance options to protect your financial future.

Contact Vivna Insurance

888-730-6001

To complete the form below to request your personalized insurance review.

Get a Free Quote

For additional information about dental and vision care, you can explore trusted health resources such as the

National Institutes of Health (NIH) and the Centers for Disease Control and Prevention (CDC).

Vivna Insurance helps individuals and families compare coverage options, including Supplemental Insurance,

to support a well-rounded insurance strategy. To explore all coverage options and resources, visit the Vivna Insurance home page

or browse the latest guides in the Vivna Insurance Blog.